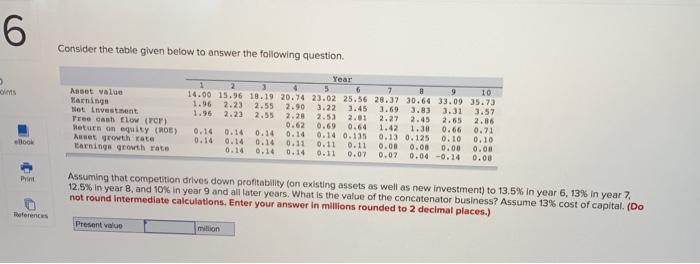

Question: 6 Consider the table given below to answer the following question 1.96 Asset value Larninga Net investment Tree cash flow (CF) Return on equity (ROE)

6 Consider the table given below to answer the following question 1.96 Asset value Larninga Net investment Tree cash flow (CF) Return on equity (ROE) et growth rate Earnings growth rate Year 1 2 3 4 6 7. 8 9 14.00 15.96 18.19 20.74 23.02 25.56 28.37 30.64 33.09 35.73 10 2.23 2.55 2.90 3.22 3.45 3.83 3.31 3.57 1.95 2.23 2.55 2.20 2.53 2.01 2.27 2.45 2.55 2.86 0.62 0.69 0.64 1.42 0.66 0.14 0.14 1.30 0.21 0.14 0.14 0.135 0.13 0.125 0.10 0.14 0.14 0.14 0.10 0.11 0.11 0.11 0.00 0.00 0.00 0.14 0.14 0.14 0.11 0.07 0.00 0.07 0.04 -0.14 0.08 Book Print Assuming that competition drives down profitability (on existing assets as well as new investment) to 13.5% in year 6, 13% in year 7 12.5% in year, and 10% in year 9 and all later years. What is the value of the concatenator business? Assume 13% cost of capital. (Do not round Intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) ferences Present value 6 Consider the table given below to answer the following question 1.96 Asset value Larninga Net investment Tree cash flow (CF) Return on equity (ROE) et growth rate Earnings growth rate Year 1 2 3 4 6 7. 8 9 14.00 15.96 18.19 20.74 23.02 25.56 28.37 30.64 33.09 35.73 10 2.23 2.55 2.90 3.22 3.45 3.83 3.31 3.57 1.95 2.23 2.55 2.20 2.53 2.01 2.27 2.45 2.55 2.86 0.62 0.69 0.64 1.42 0.66 0.14 0.14 1.30 0.21 0.14 0.14 0.135 0.13 0.125 0.10 0.14 0.14 0.14 0.10 0.11 0.11 0.11 0.00 0.00 0.00 0.14 0.14 0.14 0.11 0.07 0.00 0.07 0.04 -0.14 0.08 Book Print Assuming that competition drives down profitability (on existing assets as well as new investment) to 13.5% in year 6, 13% in year 7 12.5% in year, and 10% in year 9 and all later years. What is the value of the concatenator business? Assume 13% cost of capital. (Do not round Intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) ferences Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts