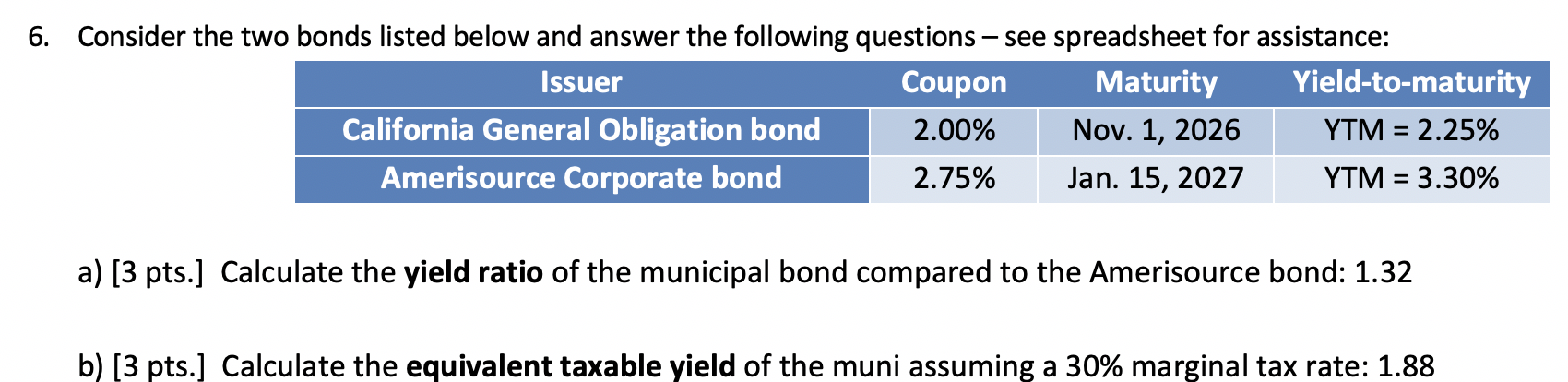

Question: 6. Consider the two bonds listed below and answer the following questions - see spreadsheet for assistance: Issuer Coupon Maturity Yield-to-maturity California General Obligation bond

6. Consider the two bonds listed below and answer the following questions - see spreadsheet for assistance: Issuer Coupon Maturity Yield-to-maturity California General Obligation bond 2.00% Nov. 1, 2026 YTM = 2.25% Amerisource Corporate bond 2.75% Jan. 15, 2027 YTM = 3.30% a) (3 pts.] Calculate the yield ratio of the municipal bond compared to the Amerisource bond: 1.32 b) (3 pts.] Calculate the equivalent taxable yield of the muni assuming a 30% marginal tax rate: 1.88

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts