Question: 6. Dividends, repunchases, and firm value Remember that the primary gogl of a firm is to maxize shareholder wealth by increasing the firm's intrinsic value,

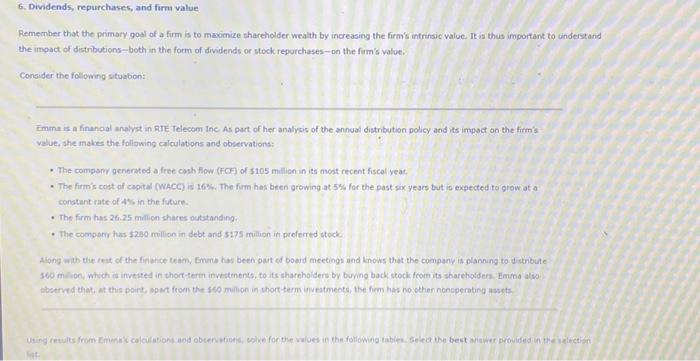

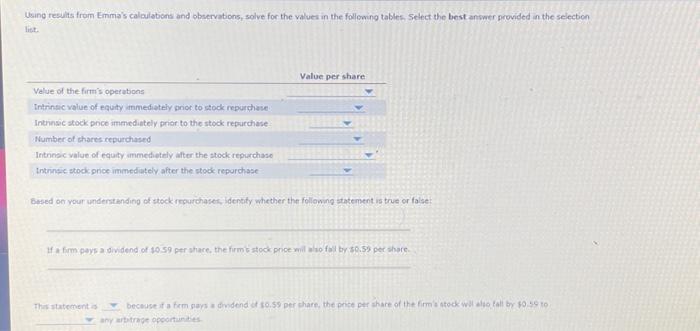

6. Dividends, repunchases, and firm value Remember that the primary gogl of a firm is to maxize shareholder wealth by increasing the firm's intrinsic value, It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases - on the firm's value. Consider the following situabon: Fimme is a finanoal aneivat in RTE Telecom Inc. As part of her analysis of the annual distribution policy and its impoct on the firm's value, she makes the follipwing calculations and obervations: - The compsry generated a free cash flow (FOF) of 5105 million in its most recent fiscal yeat. - The firmis cost of capital (wACC) is 16\%. The firm has been growing at 5% for the past six years but is expected to grow at a constant rate of 44 in the future. - The firm has 26.25 milion shares outstanding: - The coongery has $280 million in debt and 5175 million in preferred stock. Along with the test of the firbace team, Emmie has been oart of board meetings and knows that the coarpanv is olanning to distribute 360 milion, which is invested in thort-term investents, to its shareholders by byyng back stock frome its shareholders. Emusa alia ebserved that, at this port, apart feen the se0 mulion in short term ivvestmeots, the fim has no othen noncperating assets. Using results from Emma's calculabons and observabons, solve for the values in the following tables, Select the best answer provided in the selection lits: Bused oe vour understanding of stock rourchases, identily whether the following statement is true or false: any arbitrege opocrtinites

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts