Question: 6 DO 2 points Suppose analysts believe HeupelCo stock will pay annual dividends of $3.20 and $3.95 in each of the next two years, with

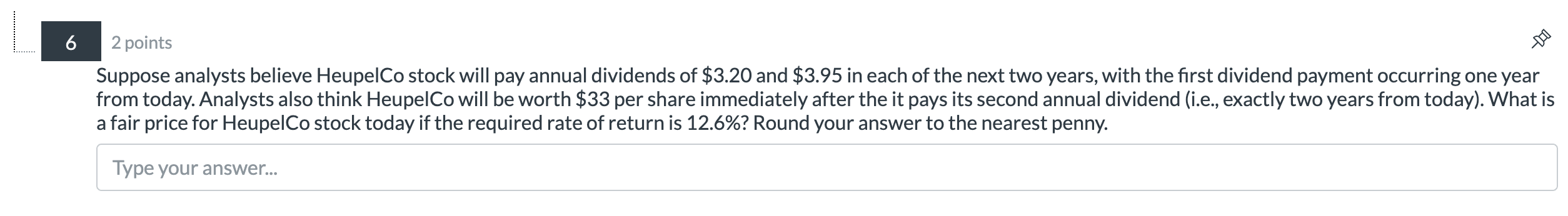

6 DO 2 points Suppose analysts believe HeupelCo stock will pay annual dividends of $3.20 and $3.95 in each of the next two years, with the first dividend payment occurring one year from today. Analysts also think HeupelCo will be worth $33 per share immediately after the it pays its second annual dividend (i.e., exactly two years from today). What is a fair price for HeupelCo stock today if the required rate of return is 12.6%? Round your answer to the nearest penny. Type your

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock