Question: 6) First Coffee is evaluating a project with a 10 year expected life. The equal annual cash inflows are expected to be $98,500. What is

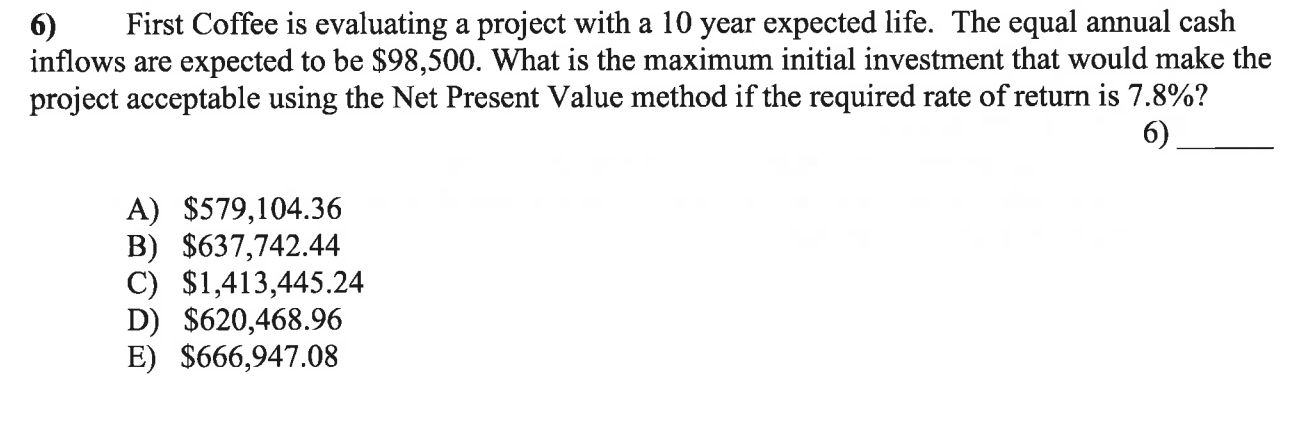

6) First Coffee is evaluating a project with a 10 year expected life. The equal annual cash inflows are expected to be $98,500. What is the maximum initial investment that would make the project acceptable using the Net Present Value method if the required rate of return is 7.8%? 6) A) $579,104.36 B) $637,742.44 C) $1,413,445.24 D) $620,468.96 E) $666,947.08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts