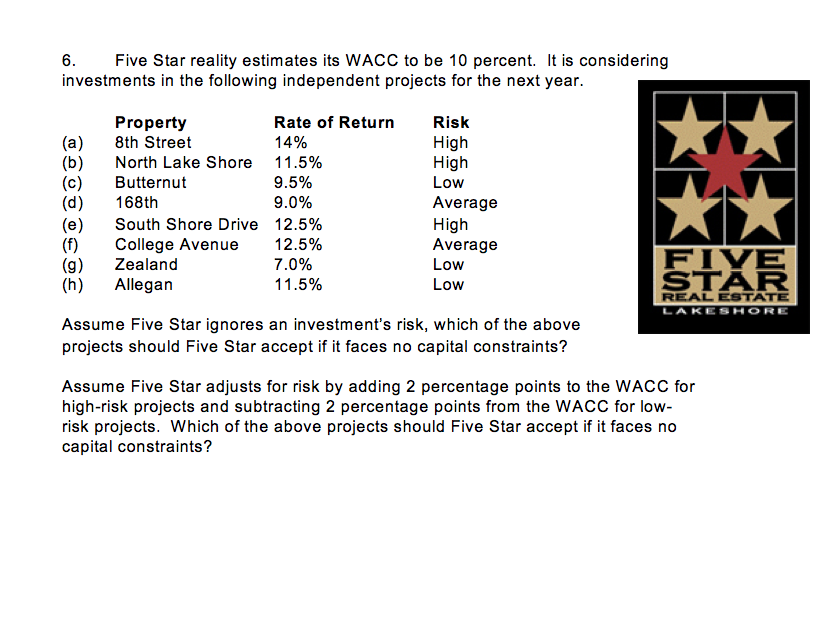

Question: 6. Five Star reality estimates its WACC to be 10 percent. It is considering investments in the following independent projects for the next year.

6. Five Star reality estimates its WACC to be 10 percent. It is considering investments in the following independent projects for the next year. Property Rate of Return Risk (a) 8th Street 14% High (b) North Lake Shore 11.5% High (c) Butternut 9.5% Low (d) 168th 9.0% Average (e) South Shore Drive 12.5% High (f) College Avenue 12.5% Average (g) Zealand Low (h) Allegan Low 7.0% 11.5% Assume Five Star ignores an investment's risk, which of the above projects should Five Star accept if it faces no capital constraints? FIVE STAR REAL ESTATE LAKESHORE Assume Five Star adjusts for risk by adding 2 percentage points to the WACC for high-risk projects and subtracting 2 percentage points from the WACC for low- risk projects. Which of the above projects should Five Star accept if it faces no capital constraints?

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

If Five Star ignores risk it should accept any project with a rate of ... View full answer

Get step-by-step solutions from verified subject matter experts