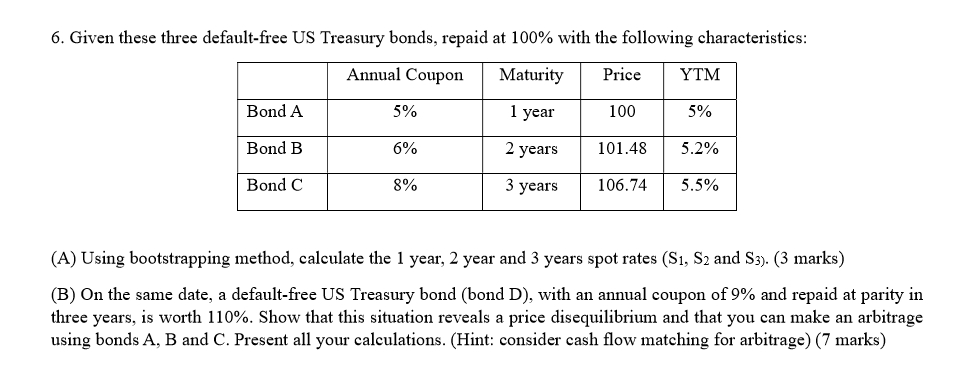

Question: 6. Given these three default-free US Treasury bonds, repaid at 100% with the following characteristics: Annual Coupon Maturity Price YTM Bond A 5% 1 year

6. Given these three default-free US Treasury bonds, repaid at 100% with the following characteristics: Annual Coupon Maturity Price YTM Bond A 5% 1 year 100 5% Bond B 6% 2 years 101.48 5.2% Bond C 8% 3 years 106.74 5.5% (A) Using bootstrapping method, calculate the 1 year, 2 year and 3 years spot rates (S1, S2 and S3). (3 marks) (B) On the same date, a default-free US Treasury bond (bond D), with an annual coupon of 9% and repaid at parity in three years, is worth 110%. Show that this situation reveals a price disequilibrium and that you can make an arbitrage using bonds A, B and C. Present all your calculations. (Hint: consider cash flow matching for arbitrage) (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts