Question: 6. IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed 250 million payable in three months. Currently, the spot exchange rate

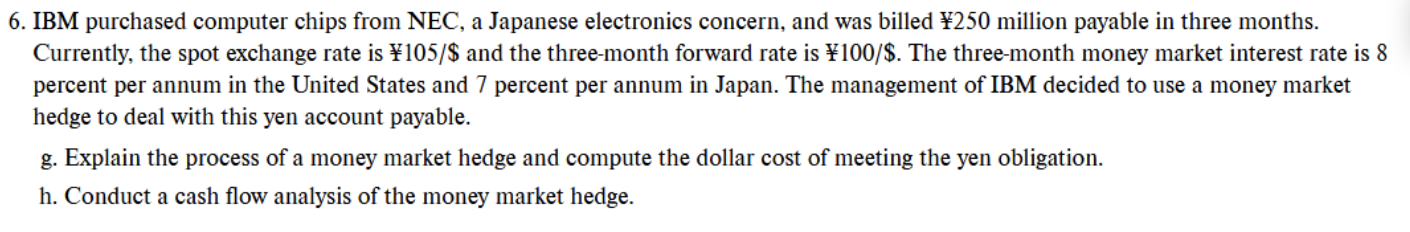

6. IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed 250 million payable in three months. Currently, the spot exchange rate is 105/$ and the three-month forward rate is 100/$. The three-month money market interest rate is 8 percent per annum in the United States and 7 percent per annum in Japan. The management of IBM decided to use a money market hedge to deal with this yen account payable. g. Explain the process of a money market hedge and compute the dollar cost of meeting the yen obligation. h. Conduct a cash flow analysis of the money market hedge. 6. IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed 250 million payable in three months. Currently, the spot exchange rate is 105/$ and the three-month forward rate is 100/$. The three-month money market interest rate is 8 percent per annum in the United States and 7 percent per annum in Japan. The management of IBM decided to use a money market hedge to deal with this yen account payable. g. Explain the process of a money market hedge and compute the dollar cost of meeting the yen obligation. h. Conduct a cash flow analysis of the money market hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts