Question: 6. Identify the incorrect statement (i) The annual exemption under capital gains are available to all assesse (ii) Chargeable gains means the gains after deducting

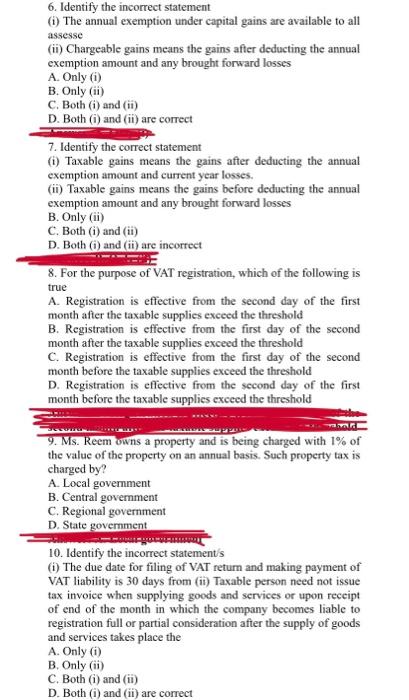

6. Identify the incorrect statement (i) The annual exemption under capital gains are available to all assesse (ii) Chargeable gains means the gains after deducting the annual exemption amount and any brought forward losses A. Only (i) B. Only (ii) C. Both (i) and (ii) D. Both (i) and (ii) are correct 7. Identify the correct statement (i) Taxable gains means the gains after deducting the annual exemption amount and current year losses. (ii) Taxable gains means the gains before deducting the annual exemption amount and any brought forward losses B. Only (ii) C. Both (i) and (ii) D. Both (i) and (ii) are incorrect 8. For the purpose of VAT registration, which of the following is true A. Registration is effective from the second day of the first month after the taxable supplies exceed the threshold B. Registration is effective from the first day of the second month after the taxable supplies exceed the threshold C. Registration is effective from the first day of the second month before the taxable supplies exceed the threshold D. Registration is effective from the second day of the first month before the taxable supplies exceed the threshold 9. Ms. Reem owns a property and is being charged with 1% of the value of the property on an annual basis. Such property tax is charged by? A. Local government B. Central government C. Regional government D. State government 10. Identify the incorrect statement/s (i) The due date for filing of VAT return and making payment of VAT liability is 30 days from (ii) Taxable person need not issue tax invoice when supplying goods and services or upon receipt of end of the month in which the company becomes liable to registration full or partial consideration after the supply of goods and services takes place the A. Only (i) B. Only (ii) C. Both (i) and (ii) D. Both (i) and (ii) are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts