Question: (6) In HW3 we considered a derivative whose payoff was s(T) at maturity, where s(t) has lognormal dynamics with constant volatility , and where the

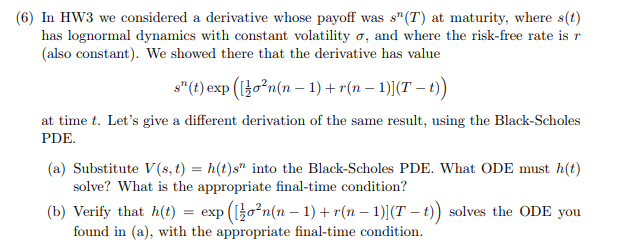

(6) In HW3 we considered a derivative whose payoff was s"(T) at maturity, where s(t) has lognormal dynamics with constant volatility , and where the risk-free rate is r (also constant). We showed there that the derivative has value s"(t) exp ( 2n(n-1) + r(n-1)](T-t) at time t. Let's give a different derivation of the same result, using the Black-Scholes IPDI (a) Substitute V(s,t)-h(t)sn nto the Black-Scholes PDE. What ODE must h(t) solve? What is the appropriate final-time condition? (b) Verify that h(t) = exp (2n(n-1) + r(n-1)](T-t)) solves the ODE you found in (a), with the appropriate final-time condition (6) In HW3 we considered a derivative whose payoff was s"(T) at maturity, where s(t) has lognormal dynamics with constant volatility , and where the risk-free rate is r (also constant). We showed there that the derivative has value s"(t) exp ( 2n(n-1) + r(n-1)](T-t) at time t. Let's give a different derivation of the same result, using the Black-Scholes IPDI (a) Substitute V(s,t)-h(t)sn nto the Black-Scholes PDE. What ODE must h(t) solve? What is the appropriate final-time condition? (b) Verify that h(t) = exp (2n(n-1) + r(n-1)](T-t)) solves the ODE you found in (a), with the appropriate final-time condition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts