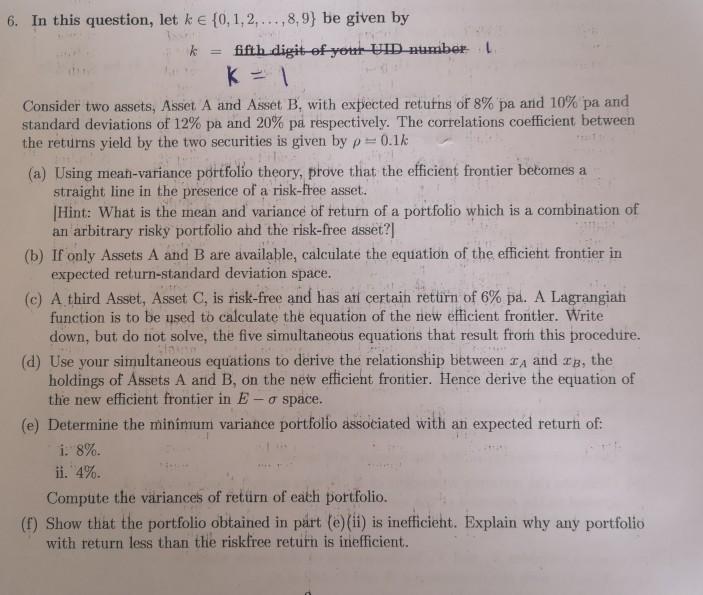

Question: 6. In this question, let k = {0,1,2,...,8,9} be given by k = fifth digit of your VID number 1 K = 1 Consider two

6. In this question, let k = {0,1,2,...,8,9} be given by k = fifth digit of your VID number 1 K = 1 Consider two assets, Asset A and Asset B, with expected returns of 8% pa and 10% pa and standard deviations of 12% pa and 20% pa respectively. The correlations coefficient between the returns yield by the two securities is given by p=0.1% (a) Using mean-variance portfolio theory, prove that the efficient frontier becomes a straight line in the preserice of a risk-free asset. Hint: What is the mean and variance of return of a portfolio which is a combination of an arbitrary risky portfolio and the risk-free asset? (b) If only Assets A and B are available, calculate the equation of the efficient frontier in expected return-standard deviation space. (c) A third Asset, Asset C, is risk-free and has ari certain return of 6% pa. A Lagrangiah function is to be used to calculate the equation of the new efficient frontier. Write down, but do not solve, the five simultaneous equations that result from this procedure. (d) Use your simultaneous equations to derive the relationship between IA and I, the holdings of Assets A and B, on the new efficient frontier. Hence derive the equation of the new efficient frontier in E-o space. (e) Determine the minimum variance portfolio associated with an expected return of: i. 8%. ii. 4%. Compute the variances of return of each portfolio. (1) Show that the portfolio obtained in part (e) (ii) is inefficient. Explain why any portfolio with return less than the riskfree return is inefficient. 6. In this question, let k = {0,1,2,...,8,9} be given by k = fifth digit of your VID number 1 K = 1 Consider two assets, Asset A and Asset B, with expected returns of 8% pa and 10% pa and standard deviations of 12% pa and 20% pa respectively. The correlations coefficient between the returns yield by the two securities is given by p=0.1% (a) Using mean-variance portfolio theory, prove that the efficient frontier becomes a straight line in the preserice of a risk-free asset. Hint: What is the mean and variance of return of a portfolio which is a combination of an arbitrary risky portfolio and the risk-free asset? (b) If only Assets A and B are available, calculate the equation of the efficient frontier in expected return-standard deviation space. (c) A third Asset, Asset C, is risk-free and has ari certain return of 6% pa. A Lagrangiah function is to be used to calculate the equation of the new efficient frontier. Write down, but do not solve, the five simultaneous equations that result from this procedure. (d) Use your simultaneous equations to derive the relationship between IA and I, the holdings of Assets A and B, on the new efficient frontier. Hence derive the equation of the new efficient frontier in E-o space. (e) Determine the minimum variance portfolio associated with an expected return of: i. 8%. ii. 4%. Compute the variances of return of each portfolio. (1) Show that the portfolio obtained in part (e) (ii) is inefficient. Explain why any portfolio with return less than the riskfree return is inefficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts