Question: 6. Last year Company E sold 6,000 units of its only product for a price of $40 per unit. Total fixed costs/expenses per

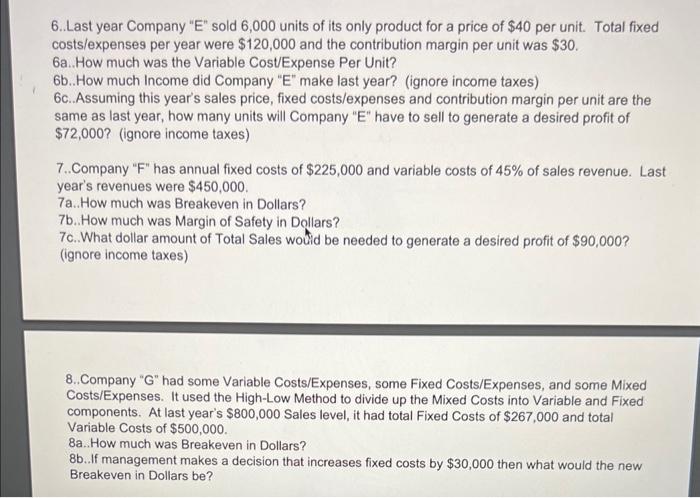

6. Last year Company " E " sold 6,000 units of its only product for a price of $40 per unit. Total fixed costs/expenses per year were $120,000 and the contribution margin per unit was $30. 6a. How much was the Variable Cost/Expense Per Unit? 6b.. How much Income did Company " E " make last year? (ignore income taxes) 6c. Assuming this year's sales price, fixed costs/expenses and contribution margin per unit are the same as last year, how many units will Company "E" have to sell to generate a desired profit of $72,000 ? (ignore income taxes) 7..Company "F" has annual fixed costs of $225,000 and variable costs of 45% of sales revenue. Last year's revenues were $450,000. 7a.. How much was Breakeven in Dollars? 7b.. How much was Margin of Safety in Dollars? 7c. What dollar amount of Total Sales woulid be needed to generate a desired profit of $90,000? (ignore income taxes) 8..Company "G" had some Variable Costs/Expenses, some Fixed Costs/Expenses, and some Mixed Costs/Expenses. It used the High-Low Method to divide up the Mixed Costs into Variable and Fixed components. At last year's $800,000 Sales level, it had total Fixed Costs of $267,000 and total Variable Costs of $500,000. 8a. How much was Breakeven in Dollars? 8b. If management makes a decision that increases fixed costs by $30,000 then what would the new Breakeven in Dollars be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts