Question: 6 Mini Problem 2 Marks: 1 Wayne and Wanda are filing MFJ with a dependent child age 4. Wayne worked full time and earned

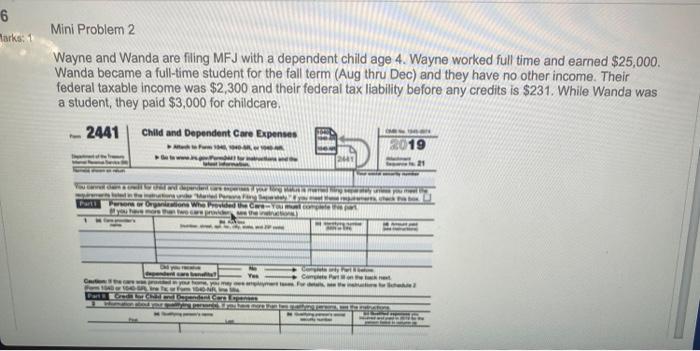

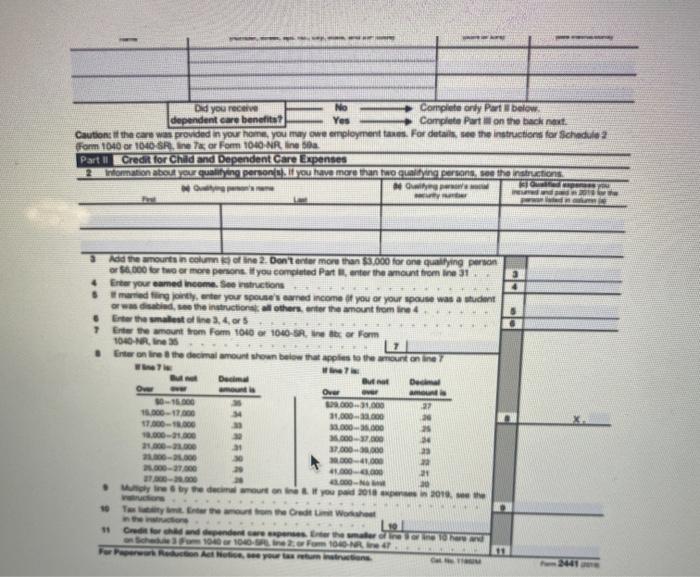

6 Mini Problem 2 Marks: 1 Wayne and Wanda are filing MFJ with a dependent child age 4. Wayne worked full time and earned $25,000. Wanda became a full-time student for the fall term (Aug thru Dec) and they have no other income. Their federal taxable income was $2,300 and their federal tax liability before any credits is $231. While Wanda was a student, they paid $3,000 for childcare. 2441 Child and Dependent Care Expenses 2019 Part more than tw Complete Pat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts