Question: 6 Module 1: Mini Practice Problem 1 Data - ACC122041 Accounting Principles || (Roxanne Phillips) SP18 - Mozilla Firefox A https://coco.desire2learn.com/d21/Me/content/2021993/fullscreen/21499168/View 67% ... v *

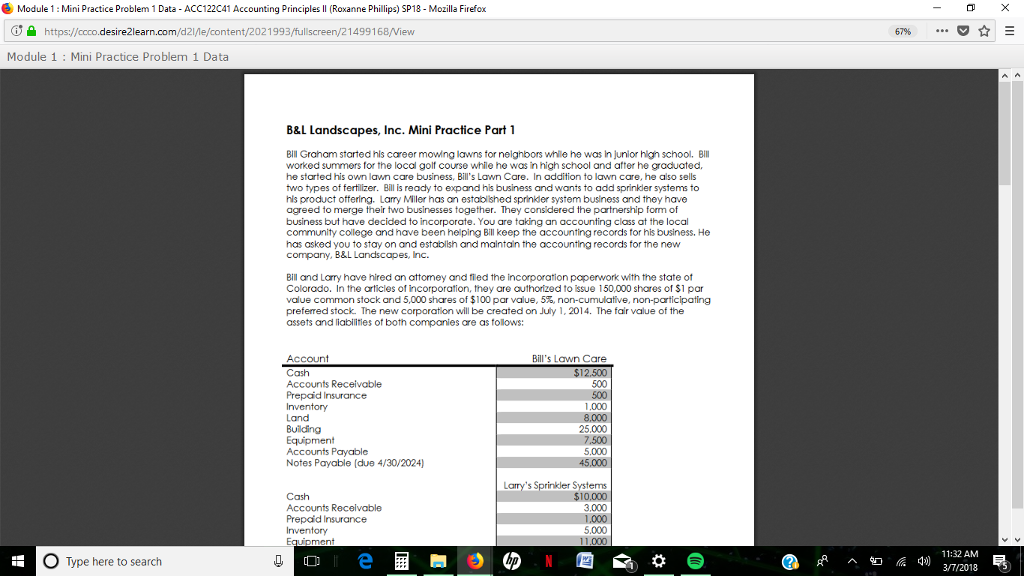

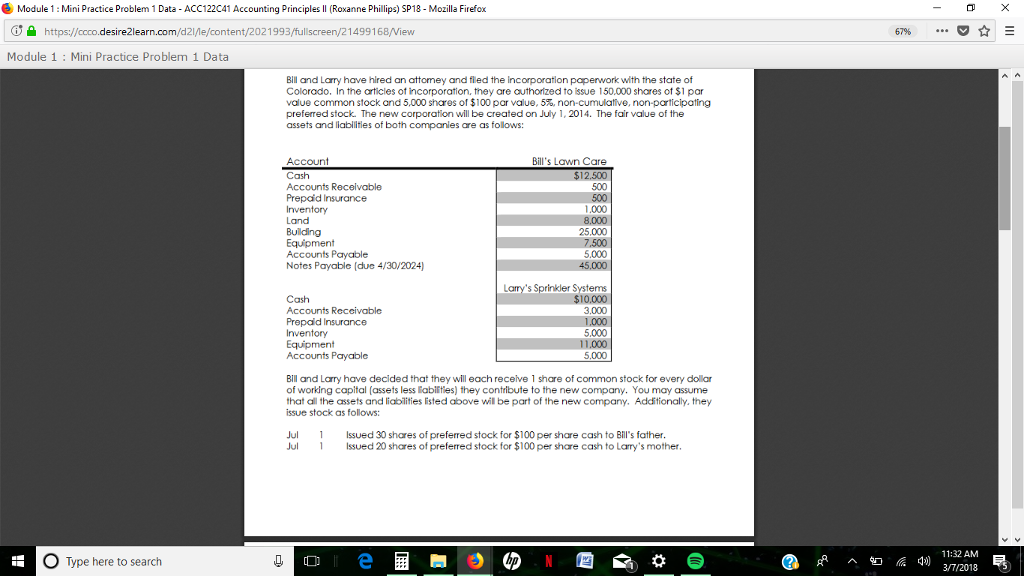

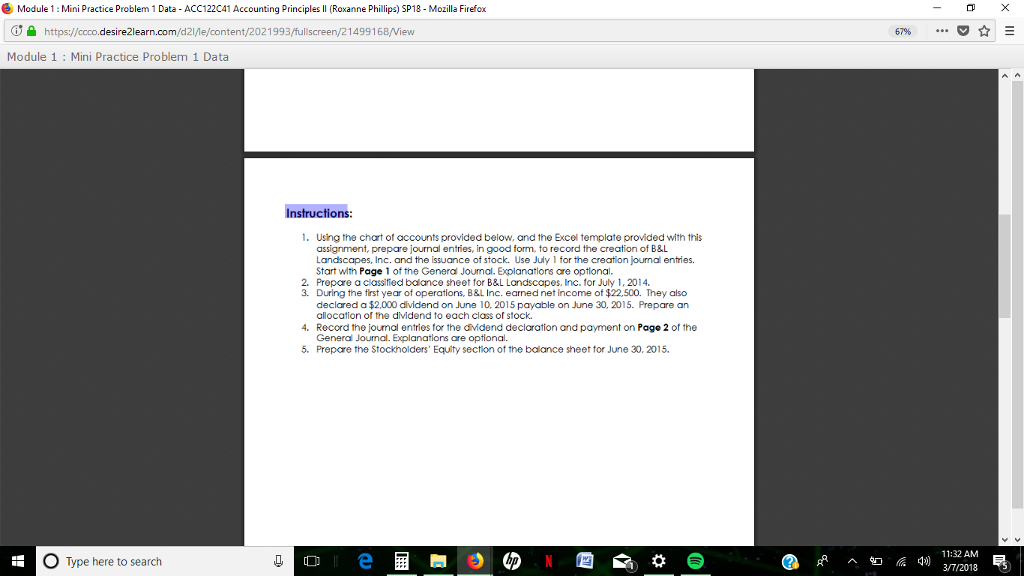

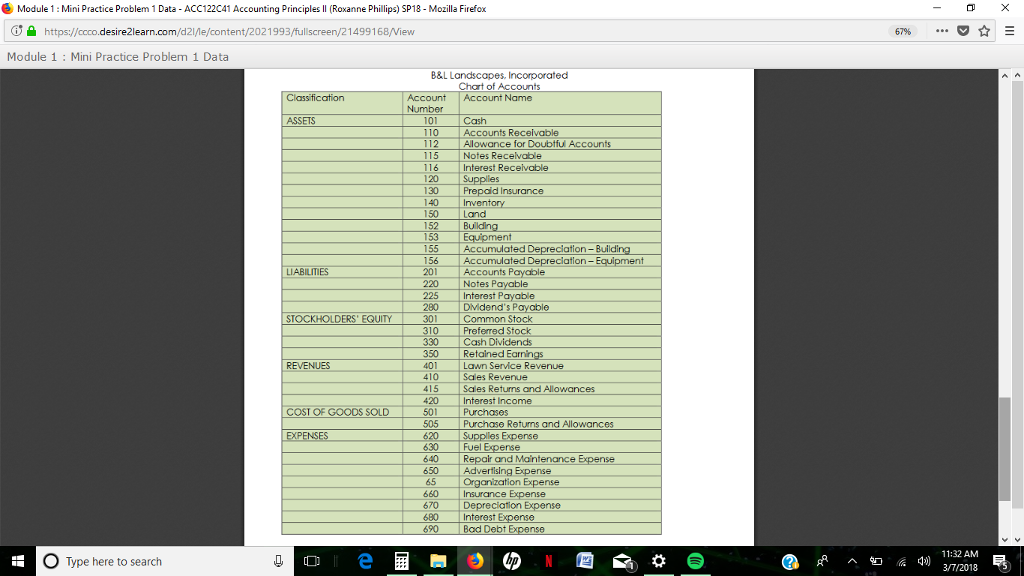

6 Module 1: Mini Practice Problem 1 Data - ACC122041 Accounting Principles || (Roxanne Phillips) SP18 - Mozilla Firefox A https://coco.desire2learn.com/d21/Me/content/2021993/fullscreen/21499168/View 67% ... v * = Module 1: Mini Practice Problem 1 Data B&L Landscapes, Inc. Mini Practice Part 1 BII Graham started his career mowing lawns for neighbors while he was in junior high school, BIN worked summers for the local golf course while he was in high school and after he graduated, he started his own lawn care business, Bill's Lawn Care. In addition to lawn care, he also sells two types of fertilizer. Bill is ready to expand his business and wants to add sprinkler systems to his product offering. Lary Miller has an established sprinkler system business and they have agreed to merge their two businesses together. They considered the partnership form of business but have decided to incorporate. You are taking an accounting class at the local community College and have been helping Bill keep the accounting records for his business. He has asked you to stay on and establish and maintain the accounting records for the new Company, B&L Landscapes, Inc. Bill and Lorry have hired an attomey and filed the incorporation paperwork with the state of Colorado. In the articles of Incorporation, they are authorized to issue 150,000 shares of $1 par value common stock and 5,000 shares of $100 par value, 5%, non-cumulative, non-participating preferred stock. The new corporation will be created on July 1, 2014. The fair value of the assets and liabilities of both companies are as follows: Bill's Lawn Care $12.500 500 Account Cash Accounts Receivable Prepaid Insurance Inventory Land Building Equipment Accounts Payable Notes Payable (due 4/30/2024) 500 1.000 8.000 25.000 7.500 5,000 45.000 Cash Accounts Receivable Prepaid Insurance Inventory Equipment 0 0 I 2 = Larry's Sprinkler Systems $10,000 3.000 1.000 5.000 11.000 E K O Type here to search A A A O ilk q) 30/2018 G A a ne das 11:32 AM 6 Module 1: Mini Practice Problem 1 Data - ACC122041 Accounting Principles || (Roxanne Phillips) SP18 - Mozilla Firefox A https://coco.desire2learn.com/d21/Me/content/2021993/fullscreen/21499168/View 67% ... v * = Module 1: Mini Practice Problem 1 Data B&L Landscapes, Inc. Mini Practice Part 1 BII Graham started his career mowing lawns for neighbors while he was in junior high school, BIN worked summers for the local golf course while he was in high school and after he graduated, he started his own lawn care business, Bill's Lawn Care. In addition to lawn care, he also sells two types of fertilizer. Bill is ready to expand his business and wants to add sprinkler systems to his product offering. Lary Miller has an established sprinkler system business and they have agreed to merge their two businesses together. They considered the partnership form of business but have decided to incorporate. You are taking an accounting class at the local community College and have been helping Bill keep the accounting records for his business. He has asked you to stay on and establish and maintain the accounting records for the new Company, B&L Landscapes, Inc. Bill and Lorry have hired an attomey and filed the incorporation paperwork with the state of Colorado. In the articles of Incorporation, they are authorized to issue 150,000 shares of $1 par value common stock and 5,000 shares of $100 par value, 5%, non-cumulative, non-participating preferred stock. The new corporation will be created on July 1, 2014. The fair value of the assets and liabilities of both companies are as follows: Bill's Lawn Care $12.500 500 Account Cash Accounts Receivable Prepaid Insurance Inventory Land Building Equipment Accounts Payable Notes Payable (due 4/30/2024) 500 1.000 8.000 25.000 7.500 5,000 45.000 Cash Accounts Receivable Prepaid Insurance Inventory Equipment 0 0 I 2 = Larry's Sprinkler Systems $10,000 3.000 1.000 5.000 11.000 E K O Type here to search A A A O ilk q) 30/2018 G A a ne das 11:32 AM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts