Question: 6. More on the AFN (Additional Funds Needed) equation Blue Elk Manufacturing reported sales of $890,000 at the end of last year; but this year,

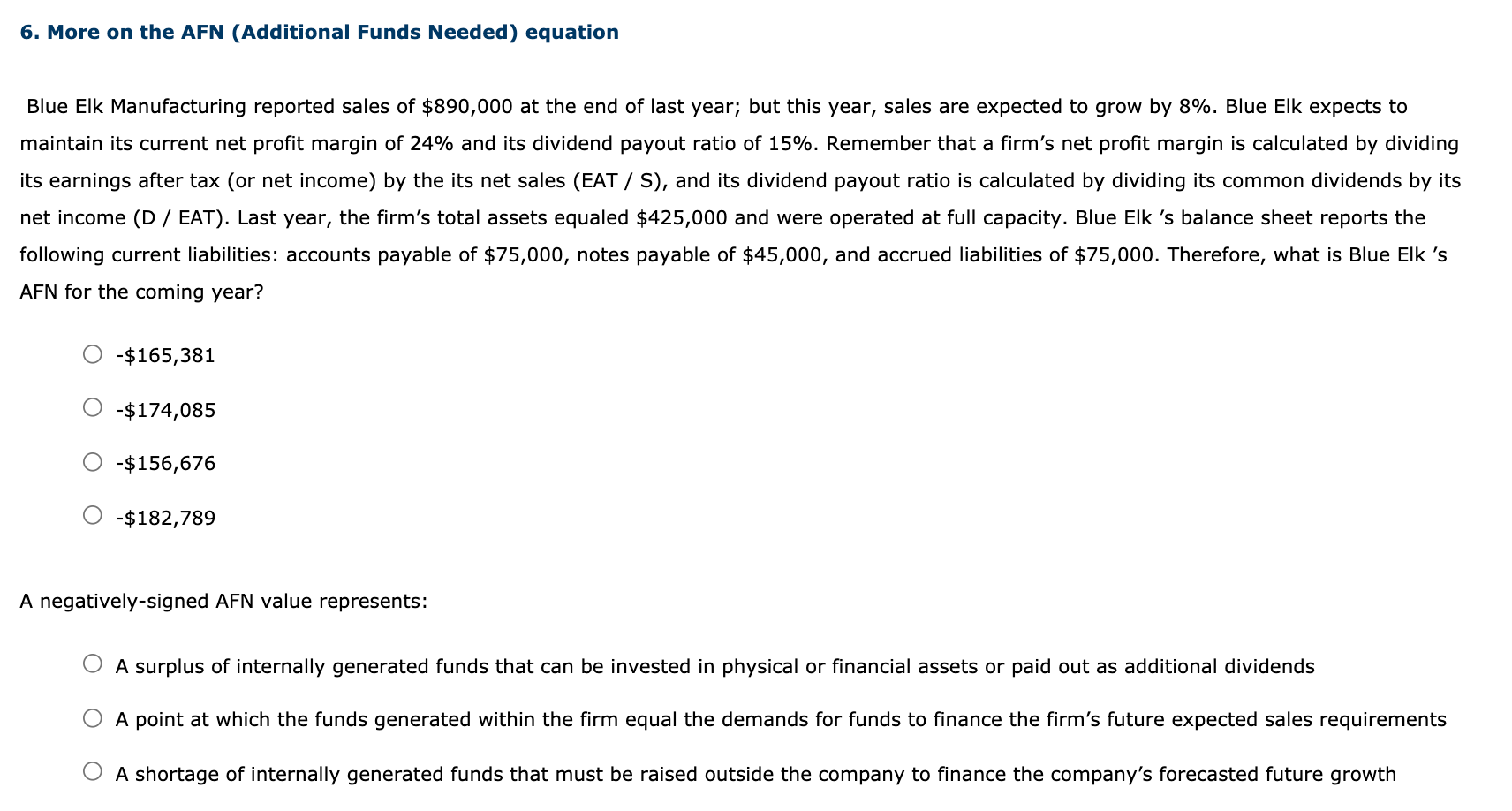

6. More on the AFN (Additional Funds Needed) equation Blue Elk Manufacturing reported sales of $890,000 at the end of last year; but this year, sales are expected to grow by 8%. Blue Elk expects to maintain its current net profit margin of 24% and its dividend payout ratio of 15%. Remember that a firm's net profit margin is calculated by dividing its earnings after tax (or net income) by the its net sales (EAT / S), and its dividend payout ratio is calculated by dividing its common dividends by its net income (D / EAT). Last year, the firm's total assets equaled $425,000 and were operated at full capacity. Blue Elk 's balance sheet reports the following current liabilities: accounts payable of $75,000, notes payable of $45,000, and accrued liabilities of $75,000. Therefore, what is Blue Elk 's AFN for the coming year? -$165,381 -$174,085 -$156,676 -$182,789 A negatively-signed AFN value represents: A surplus of internally generated funds that can be invested in physical or financial assets or paid out as additional dividends A point at which the funds generated within the firm equal the demands for funds to finance the firm's future expected sales requirements A shortage of internally generated funds that must be raised outside the company to finance the company's forecasted future growth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts