Question: 6 . Net cash flow Attempts Average / 1 Net cash flow How much cash does the firm actually have? You are the CFO of

Net cash flow Attempts

Average

Net cash flow

How much cash does the firm actually have?

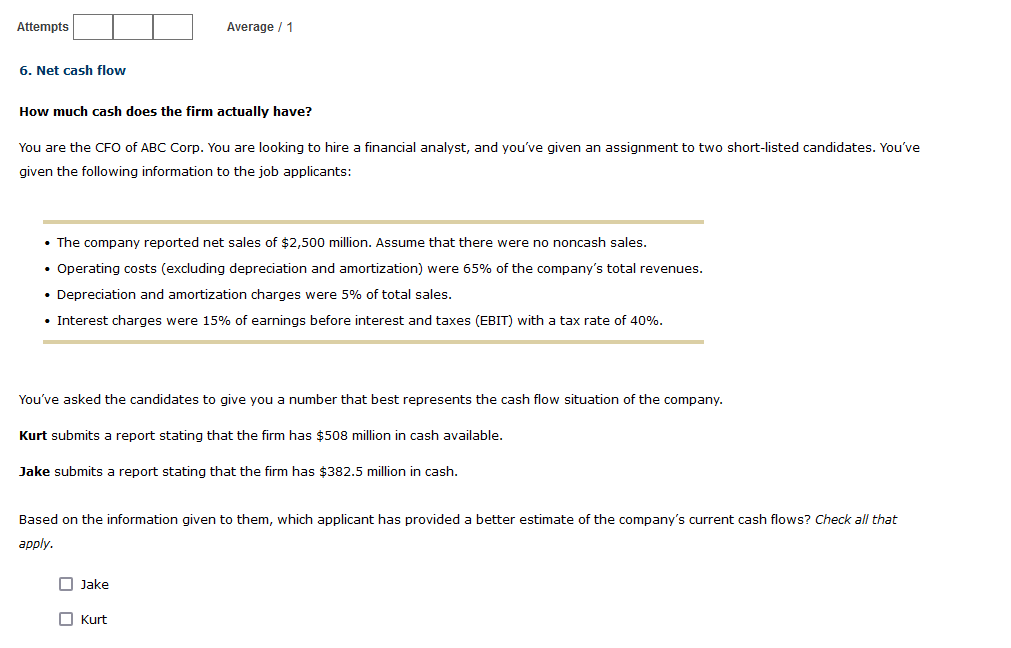

You are the CFO of ABC Corp. You are looking to hire a financial analyst, and you've given an assignment to two shortlisted candidates. You've

given the following information to the job applicants:

The company reported net sales of $ million. Assume that there were no noncash sales.

Operating costs excluding depreciation and amortization were of the company's total revenues.

Depreciation and amortization charges were of total sales.

Interest charges were of earnings before interest and taxes EBIT with a tax rate of

You've asked the candidates to give you a number that best represents the cash flow situation of the company.

Kurt submits a report stating that the firm has $ million in cash available.

Jake submits a report stating that the firm has $ million in cash.

Based on the information given to them, which applicant has provided a better estimate of the company's current cash flows? Check all that

apply.

Jake

Kurt

How much cash does the firm actually have?

You are the CFO of ABC Corp. You are looking to hire a financial analyst, and youve given an assignment to two shortlisted candidates. Youve given the following information to the job applicants:

The company reported net sales of $ million. Assume that there were no noncash sales.

Operating costs excluding depreciation and amortization were of the companys total revenues.

Depreciation and amortization charges were of total sales.

Interest charges were of earnings before interest and taxes EBIT with a tax rate of

Youve asked the candidates to give you a number that best represents the cash flow situation of the company.

Kurt submits a report stating that the firm has $ million in cash available.

Jake submits a report stating that the firm has $ million in cash.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock