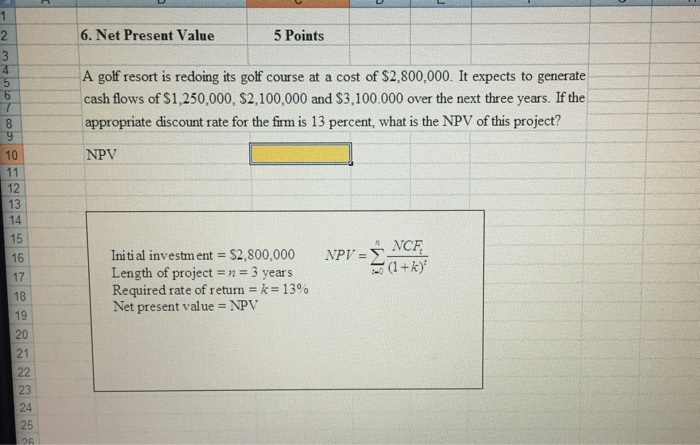

Question: 6. Net Present Value 5 Points A golf resort is redoing its golf course at a cost of $2,800,000. It expects to generate cash flows

6. Net Present Value 5 Points A golf resort is redoing its golf course at a cost of $2,800,000. It expects to generate cash flows of $1,250,000, $2,100,000 and $3,100.000 over the next three years. If the appropriate discount rate for the firm is 13 percent, what is the NPV of this project? NPV 10 12 13 14 15 16 17 18 19 20 21 CE Initial investment $2,800,000 NP Length of project3 years Required rate of return-k-13% Net present value NPV 23 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts