Question: 6: Operational Assets, Natural Resources, Intan... Saved Help Save & Exit Submit Check my work 4 Part 2 of 5 8.5 Required Information [The following

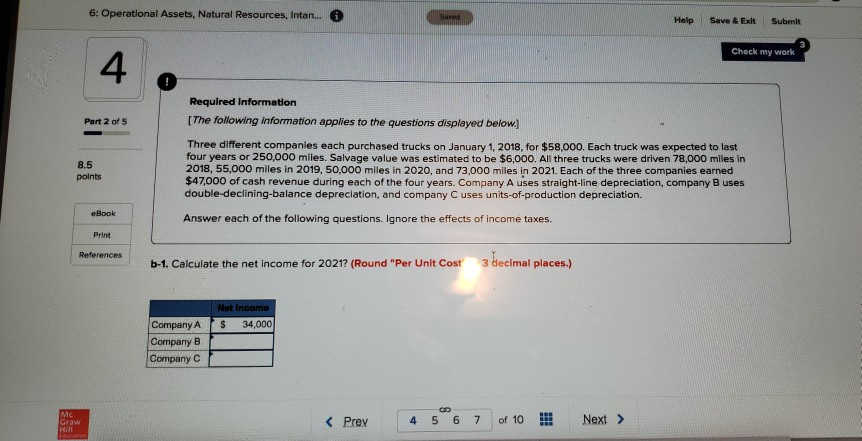

6: Operational Assets, Natural Resources, Intan... Saved Help Save & Exit Submit Check my work 4 Part 2 of 5 8.5 Required Information [The following information applies to the questions displayed below.) Three different companies each purchased trucks on January 1, 2018, for $58,000. Each truck was expected to last four years or 250,000 miles. Salvage value was estimated to be $6,000. All three trucks were driven 78,000 miles in 2018, 55,000 miles in 2019,50,000 miles in 2020, and 73,000 miles in 2021. Each of the three companies earned $47,000 of cash revenue during each of the four years. Company A uses straight-line depreciation, company B uses double-declining-balance depreciation, and company C uses units-of-production depreciation. Answer each of the following questions. Ignore the effects of income taxes. points eBook Print References b-1. Calculate the net income for 2021? (Round "Per Unit Cost 3 decimal places.) Net Income $ 34,000 Company A Company B Company CO 10 M Hill Gaw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts