Question: 6) Please help me fill out the chart with the given info, thank you! QS 3-11 (Algo) Adjusting for unearned (deferred) revenues LO P2 For

6) Please help me fill out the chart with the given info, thank you!

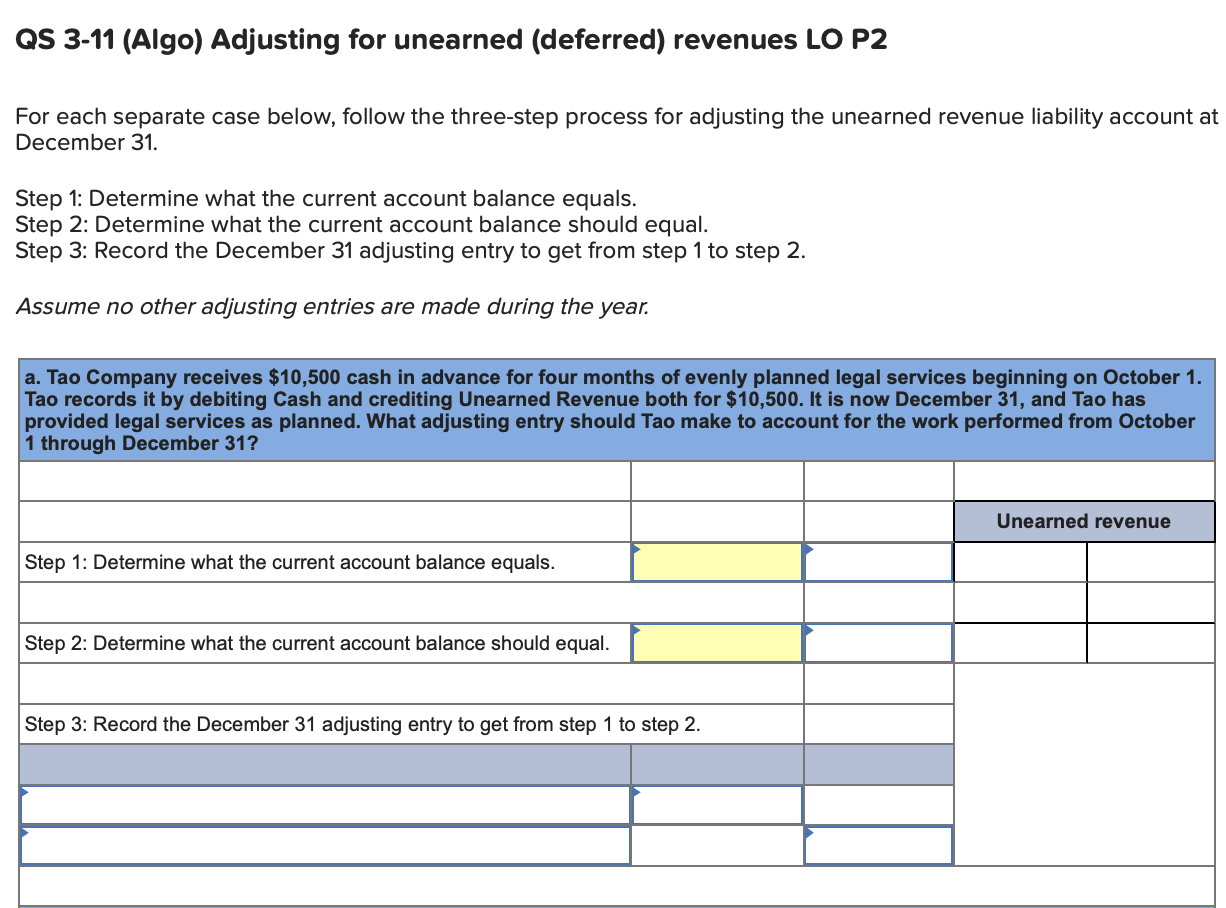

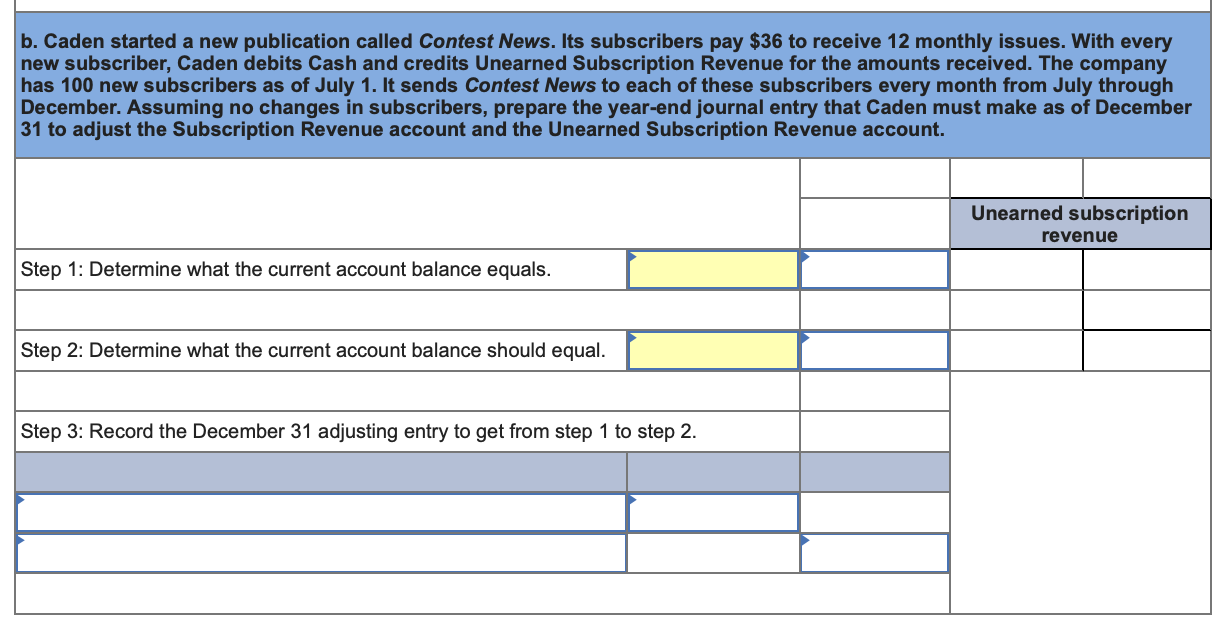

QS 3-11 (Algo) Adjusting for unearned (deferred) revenues LO P2 For each separate case below, follow the three-step process for adjusting the unearned revenue liability account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Tao Company receives $10,500 cash in advance for four months of evenly planned legal services beginning on October 1 . Tao records it by debiting Cash and crediting Unearned Revenue both for $10,500. It is now December 31 , and Tao has provided legal services as planned. What adjusting entry should Tao make to account for the work performed from October b. Caden started a new publication called Contest News. Its subscribers pay $36 to receive 12 monthly issues. With every new subscriber, Caden debits Cash and credits Unearned Subscription Revenue for the amounts received. The company has 100 new subscribers as of July 1. It sends Contest News to each of these subscribers every month from July through

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts