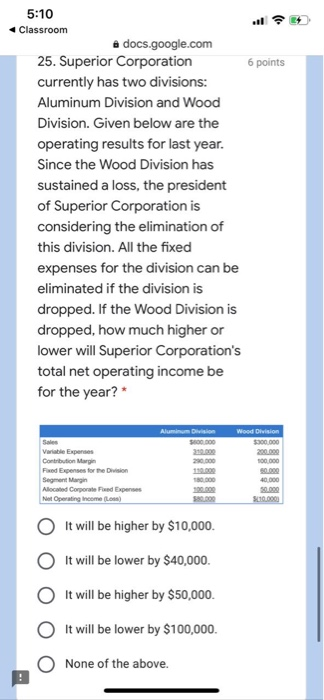

Question: . 6 points 5:10 Classroom docs.google.com 25. Superior Corporation currently has two divisions: Aluminum Division and Wood Division. Given below are the operating results for

. 6 points 5:10 Classroom docs.google.com 25. Superior Corporation currently has two divisions: Aluminum Division and Wood Division. Given below are the operating results for last year. Since the Wood Division has sustained a loss, the president of Superior Corporation is considering the elimination of this division. All the fixed expenses for the division can be eliminated if the division is dropped. If the Wood Division is dropped, how much higher or lower will Superior Corporation's total net operating income be for the year?* Aluminum Division 0.000 Se Variable Expenses Contribution Marin Fed Expenses for the Division Segment Margin Alocated Corporate Feed Expenses Net Operating income Wood Division $300.000 220 100.000 000 40 000 $110.000 It will be higher by $10,000. It will be lower by $40,000 It will be higher by $50,000 It will be lower by $100,000 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts