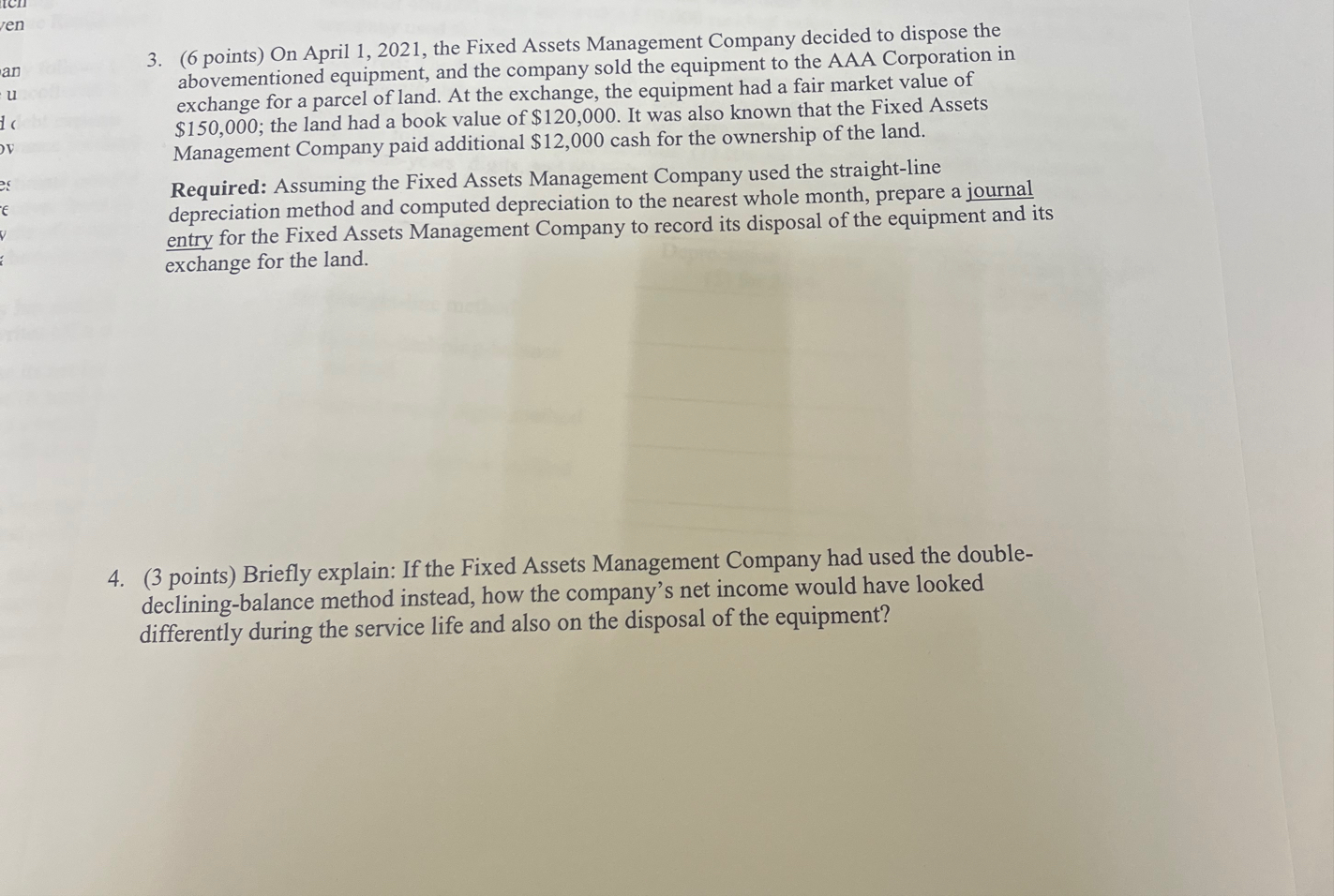

Question: ( 6 points ) On April 1 , 2 0 2 1 , the Fixed Assets Management Company decided to dispose the abovementioned equipment, and

points On April the Fixed Assets Management Company decided to dispose the abovementioned equipment, and the company sold the equipment to the AAA Corporation in exchange for a parcel of land. At the exchange, the equipment had a fair market value of $; the land had a book value of $ It was also known that the Fixed Assets Management Company paid additional $ cash for the ownership of the land.

Required: Assuming the Fixed Assets Management Company used the straightline depreciation method and computed depreciation to the nearest whole month, prepare a journal entry for the Fixed Assets Management Company to record its disposal of the equipment and its exchange for the land.

points Briefly explain: If the Fixed Assets Management Company had used the doubledecliningbalance method instead, how the company's net income would have looked differently during the service life and also on the disposal of the equipment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock