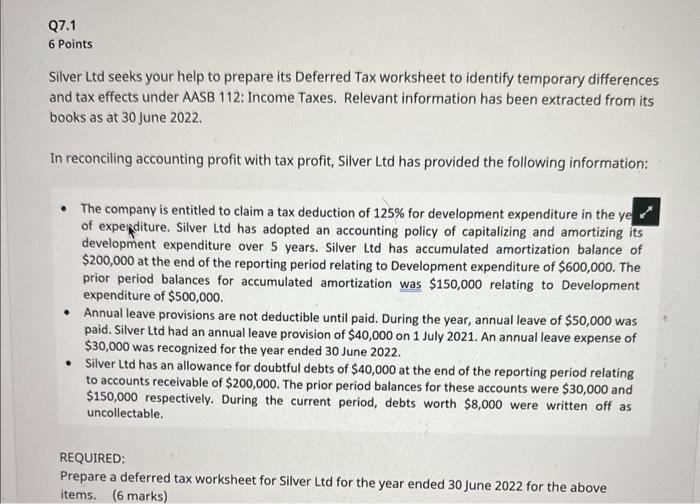

Question: 6 Points Silver Ltd seeks your help to prepare its Deferred Tax worksheet to identify temporary differences and tax effects under AASB 112: Income Taxes.

6 Points Silver Ltd seeks your help to prepare its Deferred Tax worksheet to identify temporary differences and tax effects under AASB 112: Income Taxes. Relevant information has been extracted from its books as at 30 June 2022. In reconciling accounting profit with tax profit, Silver Ltd has provided the following information: - The company is entitled to claim a tax deduction of 125% for development expenditure in the ye x of expenditure. Silver Ltd has adopted an accounting policy of capitalizing and amortizing its development expenditure over 5 years. Silver Ltd has accumulated amortization balance of $200,000 at the end of the reporting period relating to Development expenditure of $600,000. The prior period balances for accumulated amortization was $150,000 relating to Development expenditure of $500,000. - Annual leave provisions are not deductible until paid. During the year, annual leave of $50,000 was paid. Silver Ltd had an annual leave provision of $40,000 on 1 July 2021. An annual leave expense of $30,000 was recognized for the year ended 30 June 2022. - Silver Ltd has an allowance for doubtful debts of $40,000 at the end of the reporting period relating to accounts receivable of $200,000. The prior period balances for these accounts were $30,000 and $150,000 respectively. During the current period, debts worth $8,000 were written off as uncollectable. REQUIRED: Prepare a deferred tax worksheet for Silver Q7.2 2 Points What is the amount of allowable deduction for development expenditure recognized in the current tax worksheet of Silver Ltd for the year ended 30 June 2022? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts