Question: 6. Problem 5.03 (Finding the Required Interest Rate) eBook Your parents will retire in 23 years. They currently have $320,000 saved, and they think they

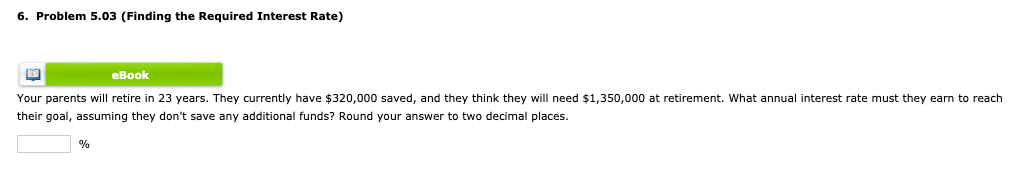

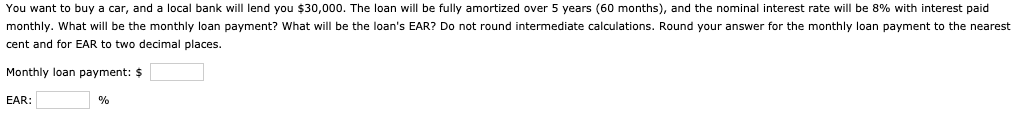

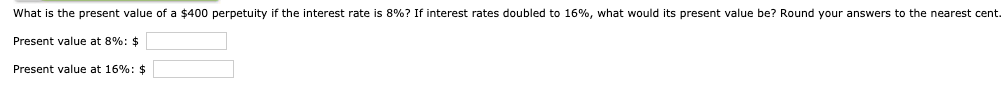

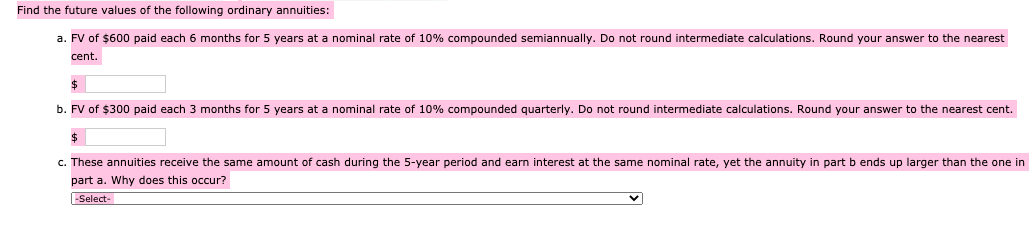

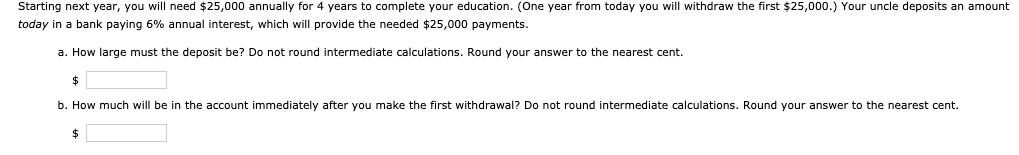

6. Problem 5.03 (Finding the Required Interest Rate) eBook Your parents will retire in 23 years. They currently have $320,000 saved, and they think they will need $1,350,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places. % You want to buy a car, and a local bank will lend you $30,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 8% with interest paid monthly. What will be the monthly loan payment? What will be the loan's EAR? Do not round intermediate calculations. Round your answer for the monthly loan payment to the nearest cent and for EAR to two decimal places. Monthly loan payment: $ EAR: % What is the present value of a $400 perpetuity if the interest rate is 8%? If interest rates doubled to 16%, what would its present value be? Round your answers to the nearest cent. Present value at 8%:$ Present value at 16%: $ Find the future values of the following ordinary annuities: a. FV of $600 paid each 6 months for 5 years at a nominal rate of 10% compounded semiannually. Do not round intermediate calculations. Round your answer to the nearest cent. $ b. FV of $300 paid each 3 months for 5 years at a nominal rate of 10% compounded quarterly. Do not round intermediate calculations. Round your answer to the nearest cent. c. These annuities receive the same amount of cash during the 5-year period and earn interest at the same nominal rate, yet the annuity in part b ends up larger than the one in part a. Why does this occur? -Select- Starting next year, you will need $25,000 annually for 4 years to complete your education. (One year from today you will withdraw the first $25,000.) Your uncle deposits an amount today in a bank paying 6% annual interest, which will provide the needed $25,000 payments. a. How large must the deposit be? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much will be in the account immediately after you make the first withdrawal? Do not round intermediate calculations. Round your answer to the nearest cent. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts