Question: 6 Problem 8-25 Cash Budger with Supporting Schedules: Changing Assumptions (LOB-2, LO0-4LO8-81 bort peaks out which occur during Me The towiction do con income tento

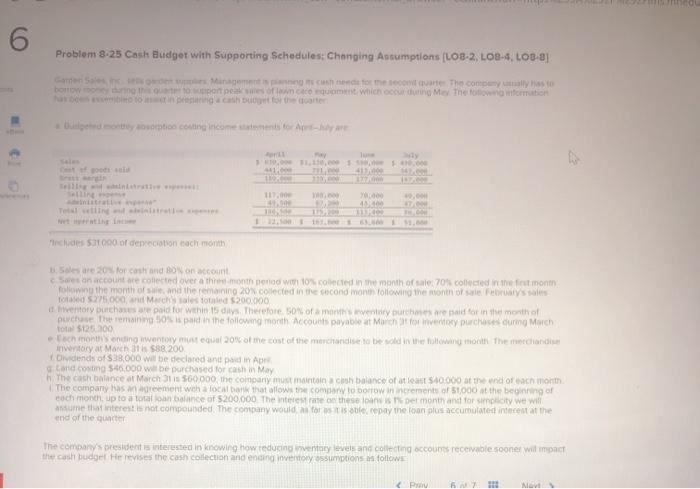

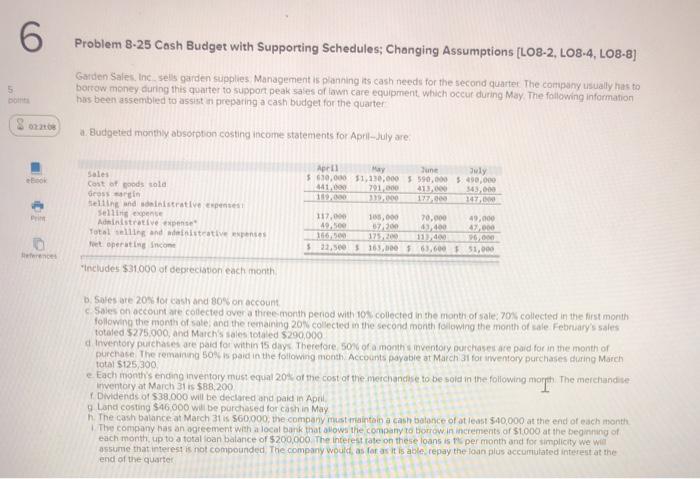

6 Problem 8-25 Cash Budger with Supporting Schedules: Changing Assumptions (LOB-2, LO0-4LO8-81 bort peaks out which occur during Me The towiction do con income tento 10. 11.0 de S000 of depreciation each month 20. for cash and on account Saeson account are collected over the month period with collected in the month of sale 70 collected in the front following the month of and the remaining 20% collected in the second mon following the month of a sales To 55000, Michalotted 200.000 it retory burchases are paid for within 15 days. Therefore of a very burchard for in the month of Queremos ispad in the followme month Accounts payable at March for investy purchases during Machi to 51251200 ach monthnung ewentory equal 20of me cost of the merchandise be in the following that the mechandise intory at March 11 SBR 200 Ovidends of 38.000 will be declared and pad in Art Cand costing 346.000 we be purchased for cash in May h. The cash balance at March 1560000, the company must maintain a clish balance of at least 540.000 at the end of each month The company agreement with a local that allows to come to borrow in increments of 51,000 at the beginning of each month up to a total loan balance of $200.000 The interest rate on these per month and for implicity we will me interests of compounded. The company would, a fost repay the foon plus accumulated incest at the end of the under the company resident is interested in knowing how educing inventory levels and collecting accounts receivable sooner will impact the cast budget He revise the cash collection and ending inventory sutions follow

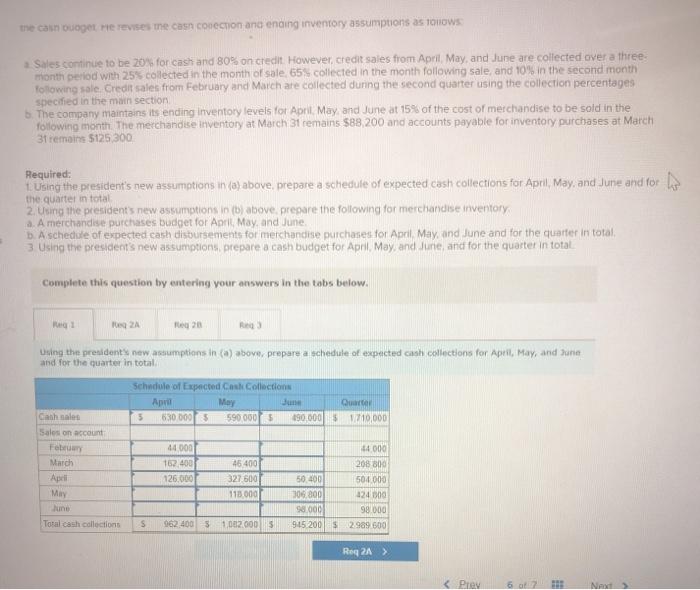

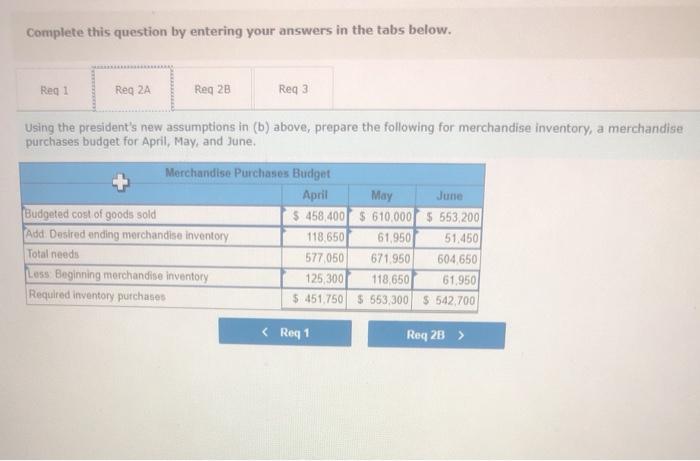

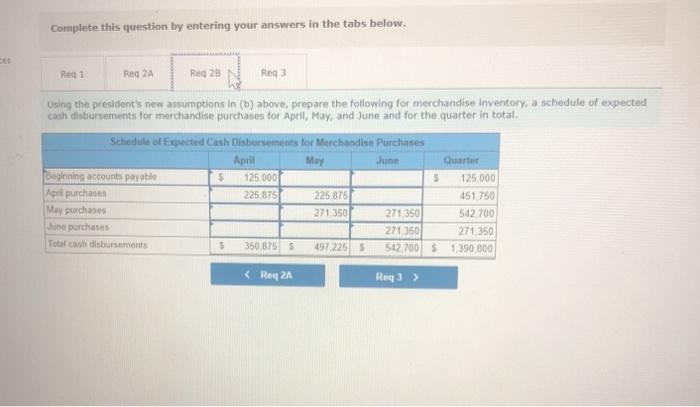

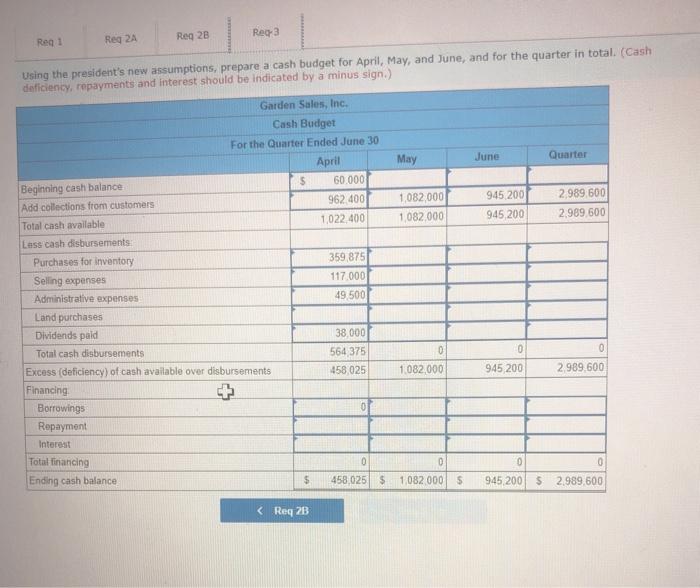

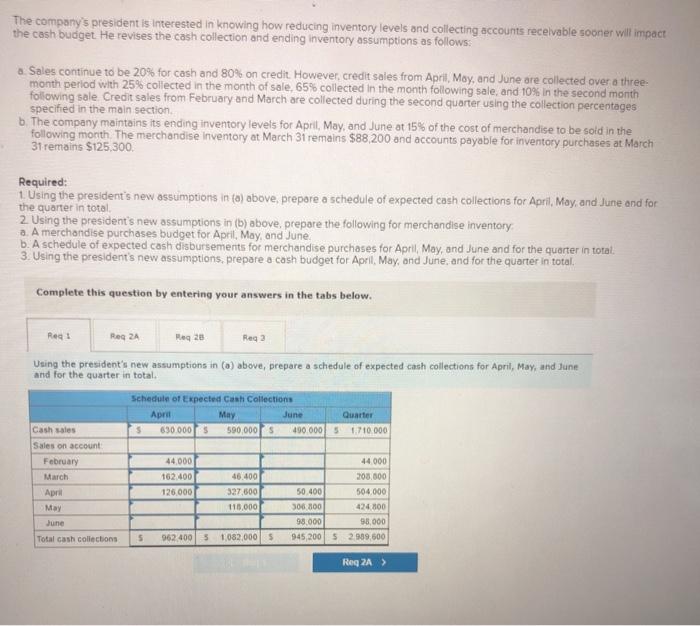

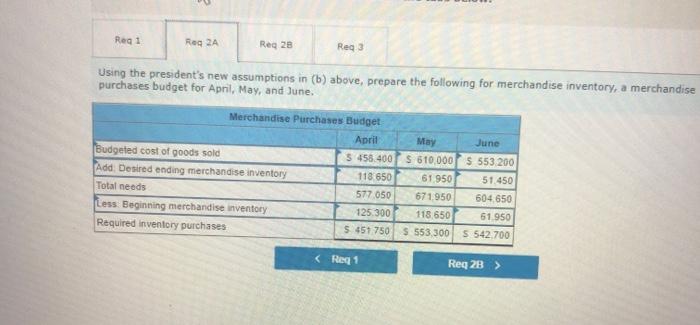

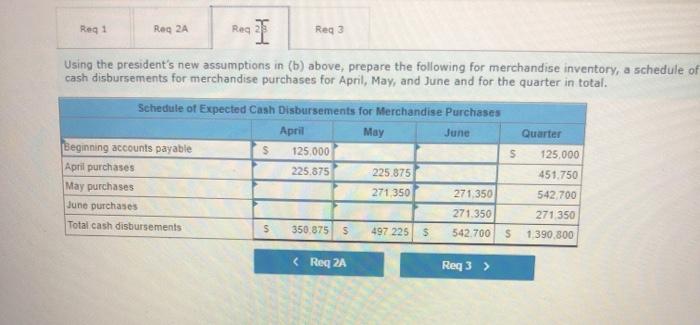

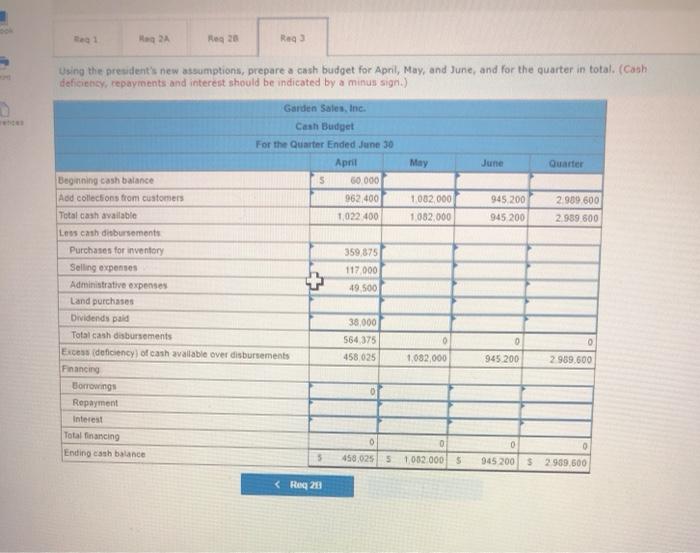

Req3 Reg 2B Regi Reg 2 Using the president's new assumptions, prepare a cash budget for April, May, and June, and for the quarter in total. (Cash deficiency, repayments and interest should be indicated by a minus sign.) May June Quarter 1,082,000 1,082,000 945 200 945 200 2.989,600 2.989 600 Garden Sales, Inc. Cash Budget For the Quarter Ended June 30 April 60.000 Beginning cash balance Add collections from customers 962 400 Total cash available 1,022 400 Lass cash disbursements: Purchases for inventory 359 875 Selling expenses 117.000 Administrative expenses 49 500 Land purchases Dividends paid 38.000 Total cash disbursements 564 375 Excess (deficiency) of cash available over disbursements 458 025 Financing Borrowings 0 Repayment Interest Total financing 0 Ending cash balance $ 458,025 $ 0 0 0 1.082.000 945 200 2.989,600 0 0 0 945 200 1082 000 5 $ 2.989 600 Reg1 Reg 2A Reg 28 Reg Using the president's new assumptions in (b) above, prepare the following for merchandise inventory, a merchandise purchases budget for April, May, and June. Merchandise Purchases Budget April May June Budgeted cost of goods sold 5458 400 $ 610.000 $ 553 200 Add Desired ending merchandise inventory 118 650 61 950 51.450 Total needs 577.050 671 950 604 650 Less. Beginning merchandise inventory 125.300 118.650 61.950 Required Inventory purchases 5451 750 $ 553 300 5 542.700 Reg 2 Reg 1 Reg 1 Reg 3 Using the president's new assumptions in (b) above, prepare the following for merchandise inventory, a schedule of cash disbursements for merchandise purchases for April, May, and June and for the quarter in total. Schedule of Expected Cash Disbursements for Merchandise Purchases April May June Quarter Beginning accounts payable $ 125.000 S 125.000 April purchases 225.875 225 875 451.750 May purchases 271 350 271,350 542.700 June purchases 271.350 271 350 Total cash disbursements S 350.8755 497 225 $ 542.700 S 1 390.800 HA Reg 20 Reg D Using the president's new assumptions, prepare a cash budget for April, May, and June, and for the quarter in total. (Cash deficiency, repayments and interest should be indicated by a minus sign.) Garden Sales, Inc. Cash Budget For the Quarter Ended June 30 April May June Quarter Beginning cash balance 50.000 Add collections from customers 962400 1 002 000 945 200 2.939 600 Total cash available 1,022 400 1082.000 945 200 2 989 500 Les cash disbursements Purchases for inventory 359.875 Selling expenses 117 000 Administrative expenses 49.500 Land purchases Dividends paid 38.000 Total cash disbursements 564 375 0 0 Excess deficiency of cash available over disbursements 458 025 1,082,000 945 200 2 959.600 Financing Borrowing Repayment Interest Total sancing 0 0 0 Ending cash balance 5 458,025 5 1 002 000 5 945 200 $ 2.999.500 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts