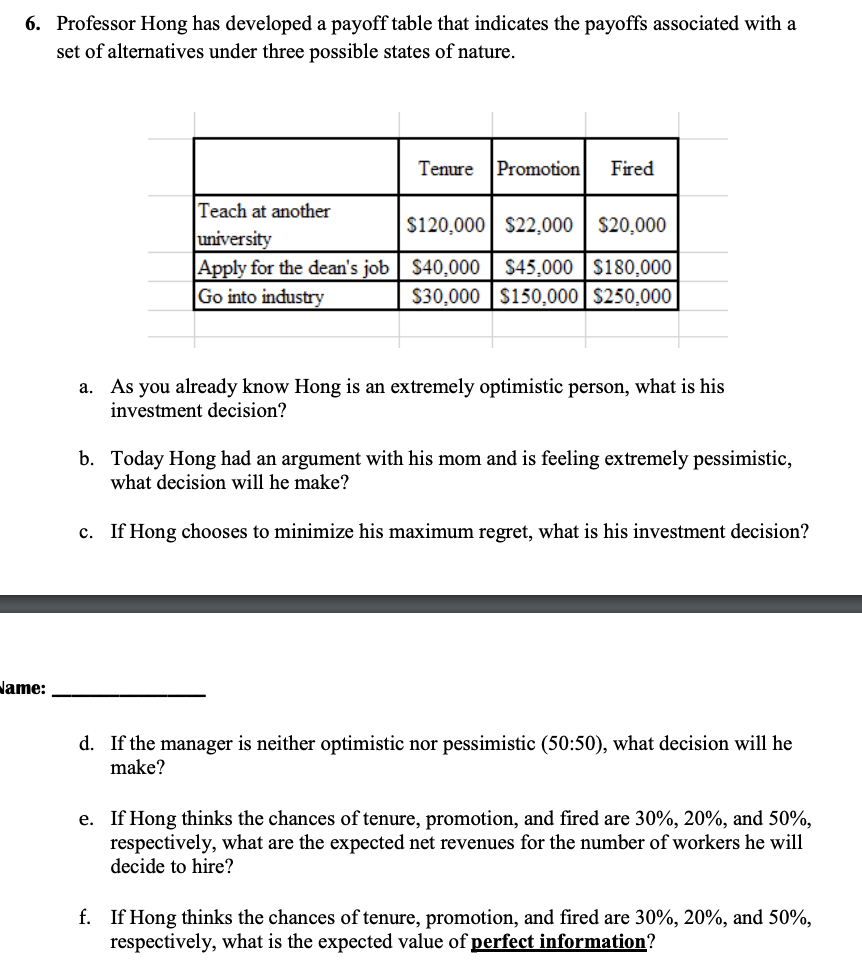

Question: 6. Professor Hong has developed a payoff table that indicates the payoffs associated with a set of alternatives under three possible states of nature. a.

6. Professor Hong has developed a payoff table that indicates the payoffs associated with a set of alternatives under three possible states of nature. a. As you already know Hong is an extremely optimistic person, what is his investment decision? b. Today Hong had an argument with his mom and is feeling extremely pessimistic, what decision will he make? c. If Hong chooses to minimize his maximum regret, what is his investment decision? d. If the manager is neither optimistic nor pessimistic (50:50), what decision will he make? e. If Hong thinks the chances of tenure, promotion, and fired are 30%,20%, and 50%, respectively, what are the expected net revenues for the number of workers he will decide to hire? f. If Hong thinks the chances of tenure, promotion, and fired are 30%,20%, and 50%, respectively, what is the expected value of perfect information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts