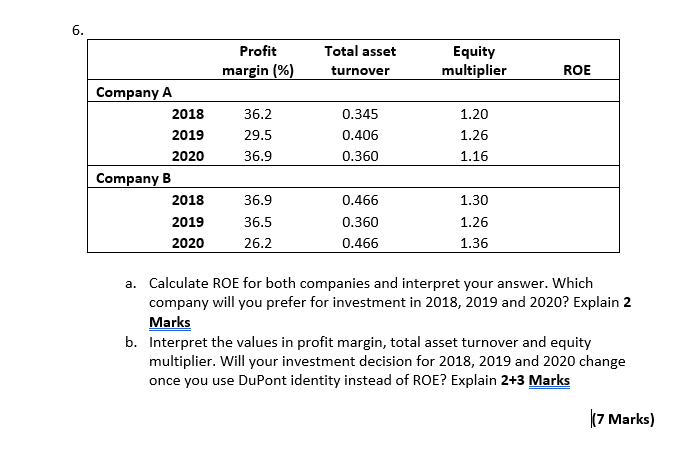

Question: 6. . Profit Total asset Equity multiplier margin (%) turnover ROE Company A 2018 36.2 0.345 1.20 2019 29.5 0.406 1.26 2020 36.9 0.360 1.16

6. . Profit Total asset Equity multiplier margin (%) turnover ROE Company A 2018 36.2 0.345 1.20 2019 29.5 0.406 1.26 2020 36.9 0.360 1.16 Company B 2018 36.9 0.466 1.30 2019 36.5 0.360 1.26 2020 26.2 0.466 1.36 a. Calculate ROE for both companies and interpret your answer. Which company will you prefer for investment in 2018, 2019 and 2020? Explain 2 Marks b. Interpret the values in profit margin, total asset turnover and equity multiplier. Will your investment decision for 2018, 2019 and 2020 change once you use DuPont identity instead of ROE? Explain 2+3 Marks |(7 Marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock