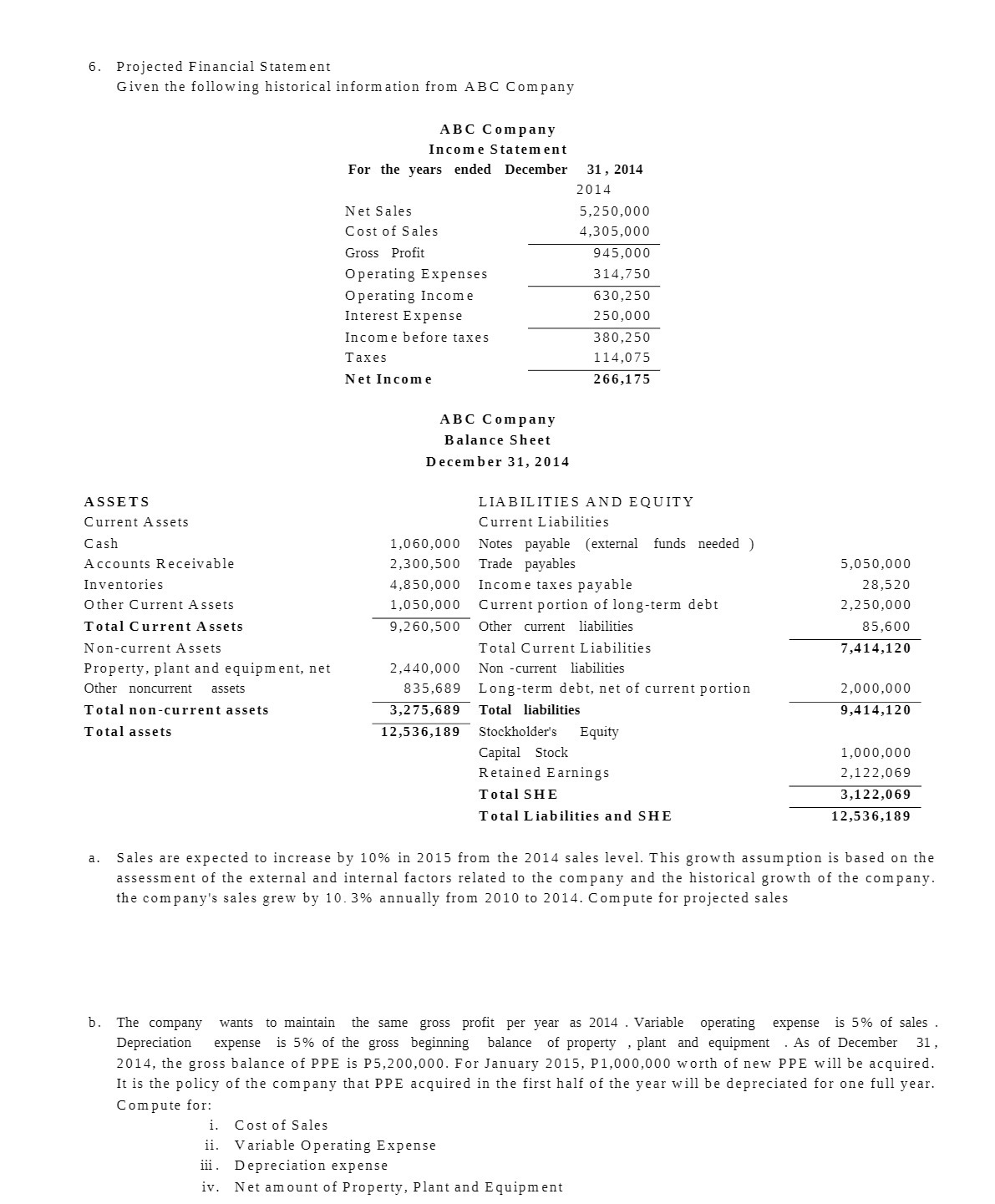

Question: 6. Projected Financial Statement Given the following historical information from ABC Company ABC Company Income Statement For the years ended December 31, 2014 2014 Net

6. Projected Financial Statement Given the following historical information from ABC Company ABC Company Income Statement For the years ended December 31, 2014 2014 Net Sales 5,250,000 Cost of Sales 4,305,000 Gross Profit W Operating Expenses 314,750 Operating Income 630,250 Interest Expense 250,000 Income before taxes W Taxes 114,025 Net Income W ABC Company Balance Sheet December 31, 2014 ASSETS LIABILITIES AND EQUITY Current Assets Current Liabilities Cash 1,060,000 Notes payable [external funds needed ) Accounts Receivable 2,300,500 Trade payables 5,050,000 Inventories 4,850,000 Income taxes payable 28,520 Other Current Assets 1,050,000 Current portion of long-term debt 2,250,000 Total Current Assets W Other current liabilities 85,600 Noncurrent Assets Total Current Liabilities W Property, plant and equipment, net 2,440,000 Non current liabilities Other noncurrent assets 835,689 Longterm debt, net of current portion 2,000,000 Total nonrcurrent assets W Total liabilities W Total assets W Stockholder's Equity Capital Stock 1,000,000 Retained Earnings 2,122,069 Total SHE W Total Liabilities and SHE W a. Sales are expected to increase by 10% in 2015 from the 2014 sales level. This growth assumption is based on the assessment of the external and internal factors related to the company and the historical growth of the company. the company's sales grew by 10. 3% annually from 2010 to 2014. Compute for projected sales b. The company wants to maintain the same gross prot per year as 2014 .Variable operating expense is 5% of sales . Depreciation expense is 5% of the gross beginning balance of property , plant and equipment .As of December 31, 2014, the gross balance of PPE is P5,200,000. For January 2015, P1,000,000 worth of new PPE will be acquired. It is the policy of the company that PPE acquired in the first half of the year will be depreciated for one full year. Compute for: i. Cost of Sales ii. Variable Operating Expense iii. Depreciation expense iv. Net amount of Property, Plant and Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts