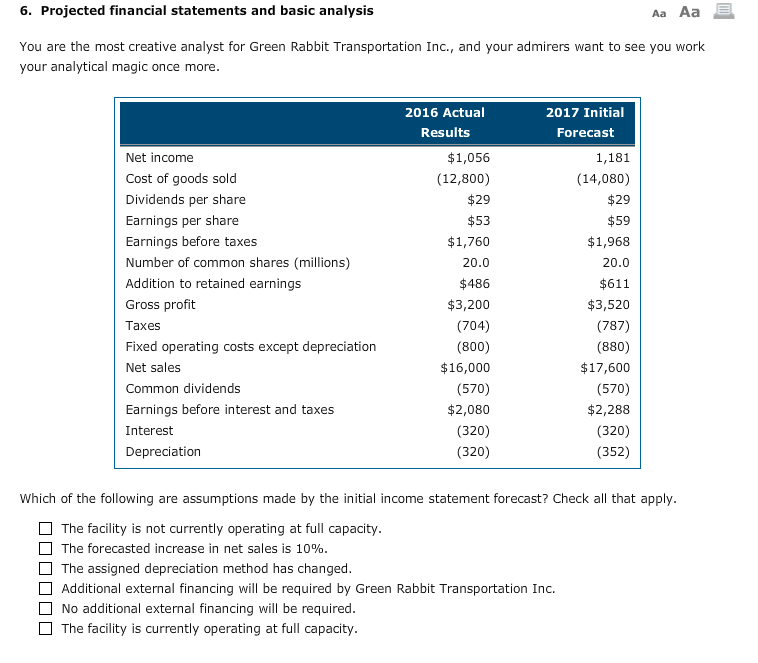

Question: 6. Projected financial statements and basic analysis Aa Aa E You are the most creative analyst for Green Rabbit Transportation Inc., and your admirers want

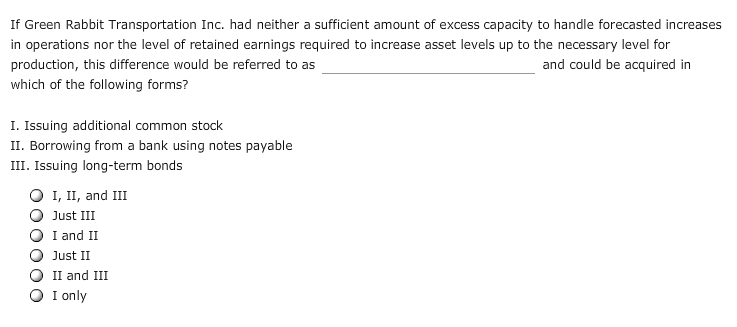

6. Projected financial statements and basic analysis Aa Aa E You are the most creative analyst for Green Rabbit Transportation Inc., and your admirers want to see you work your analytical magic once more. Net income Cost of goods sold Dividends per share Earnings per share Earnings before taxes Number of common shares (millions) Addition to retained earnings Gross profit Taxes Fixed operating costs except depreciation Net sales Common dividends Earnings before interest and taxes Interest Depreciation 2016 Actual Results $1,056 (12,800) $29 $53 $1,760 20.0 $486 $3,200 (704) (800) $16,000 (570) $2,080 (320) (320) 2017 Initial Forecast 1,181 (14,080) $29 $59 $1,968 20.0 $611 $3,520 (787) (880) $17,600 (570) $2,288 (320) (352) Which of the following are assumptions made by the initial income statement forecast? Check all that apply. The facility is not currently operating at full capacity. The forecasted increase in net sales is 10%. The assigned depreciation method has changed. Additional external financing will be required by Green Rabbit Transportation Inc. No additional external financing will be required. The facility is currently operating at full capacity. If Green Rabbit Transportation Inc. had neither a sufficient amount of excess capacity to handle forecasted increases in operations nor the level of retained earnings required to increase asset levels up to the necessary level for production, this difference would be referred to as and could be acquired in which of the following forms? I. Issuing additional common stock II. Borrowing from a bank using notes payable III. Issuing long-term bonds O O O I, II, and III Just III I and II Just II II and III I only O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts