Question: 6. Put options on a stock are available with strike prices Ki = $10, K2 = $20 and K3 = $30 and are selling for

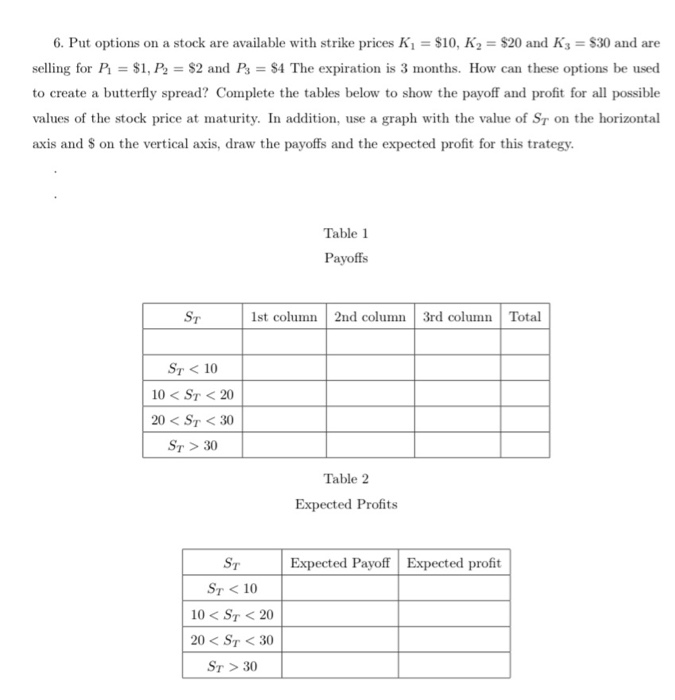

6. Put options on a stock are available with strike prices Ki = $10, K2 = $20 and K3 = $30 and are selling for P = $1, P2 = $2 and P3 = $4 The expiration is 3 months. How can these options be used to create a butterfly spread? Complete the tables below to show the payoff and profit for all possible values of the stock price at maturity. In addition, use a graph with the value of Sr on the horizontal axis and on the vertical axis, draw the payoffs and the expected profit for this trategy. Table 1 Payoffs ST 1st column 2nd column 3rd column Total ST 30 Table 2 Expected Profits Expected Payoff Expected profit ST Sr 30

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock