Question: (6) QRW Corp. needs to replace an old machine with a new, more efficient model. The new machine being considered will result in an increase

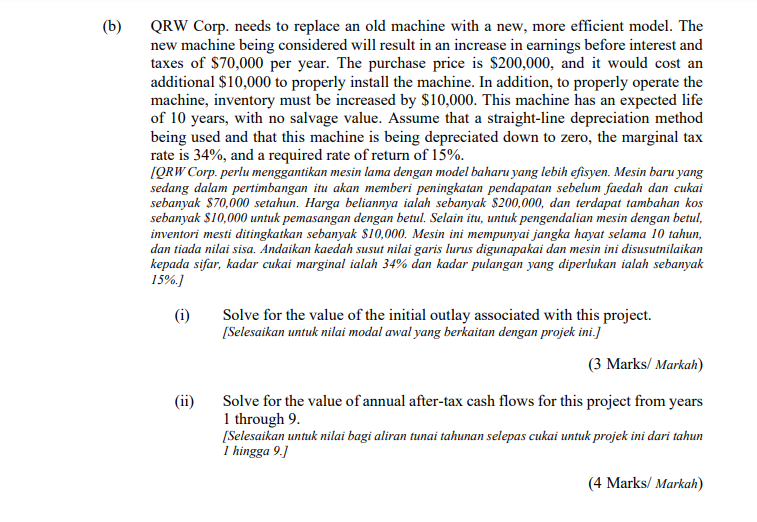

(6) QRW Corp. needs to replace an old machine with a new, more efficient model. The new machine being considered will result in an increase in earnings before interest and taxes of $70,000 per year. The purchase price is $200,000, and it would cost an additional $10,000 to properly install the machine. In addition, to properly operate the machine, inventory must be increased by $10,000. This machine has an expected life of 10 years, with no salvage value. Assume that a straight-line depreciation method being used and that this machine is being depreciated down to zero, the marginal tax rate is 34%, and a required rate of return of 15%. (QRW Corp. perlu menggantikan mesin lama dengan model baharu yang lebih efisyen. Mesin baru yang sedang dalam pertimbangan itu akan memberi peningkatan pendapatan sebelum faedah dan cukai sebanyak $70,000 setahun. Harga beliannya ialah sebanyak $200,000, dan terdapat tambahan kos sebanyak $10,000 untuk pemasangan dengan betul. Selain itu, untuk pengendalian mesin dengan betul, inventori mesti ditingkatkan sebanyak $10,000. Mesin ini mempunyai jangka hayat selama 10 tahun, dan tiada nilai sisa. Andaikan kaedah susut nilai garis lurus digunapakai dan mesin ini disusutnilaikan kepada sifar, kadar cukai marginal ialah 34% dan kadar pulangan yang diperlukan ialah sebanyak 15%.] (1) Solve for the value of the initial outlay associated with this project. [Selesaikan untuk nilai modal awal yang berkaitan dengan projek ini.) (3 Marks/ Markah) (ii) Solve for the value of annual after-tax cash flows for this project from years 1 through 9. [Selesaikan untuk nilai bagi aliran tunai tahunan selepas cukai untuk projek ini dari tahun 1 hingga 9. (4 Marks/ Markah)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts