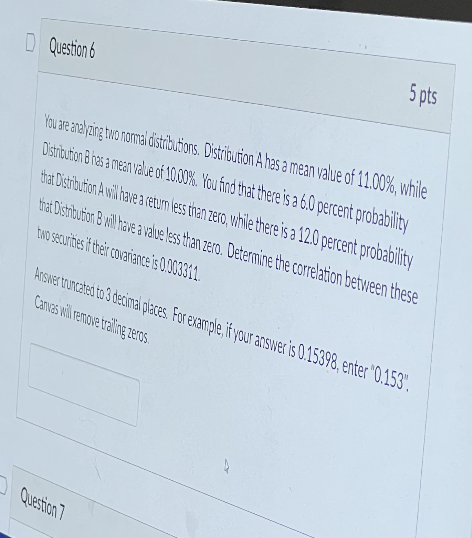

Question: 6) Question 6 5 pts You are analyzing two normal distributions. Distribution Ahas a mean value of 11.00%, while Distribution B has a mean value

6)

Question 6 5 pts You are analyzing two normal distributions. Distribution Ahas a mean value of 11.00%, while Distribution B has a mean value of 1000%. You ford that there is a 6.0 percent probability that Distribution will have a return less than zero, while there is a 12.0 percent probability torat Distribution B will have a value less than zero. Determine the correlation between these two securities 't their covariance is 0.003311 Answer truncated to 3 decimal places. For example, if your answer is 0.15398, enter 0.153". Cannes will remove training zeros

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts