Question: 6. Research and list 3 examples the BAS related services that a registered BAS agent is authorised to provide to the customers. 7. Research and

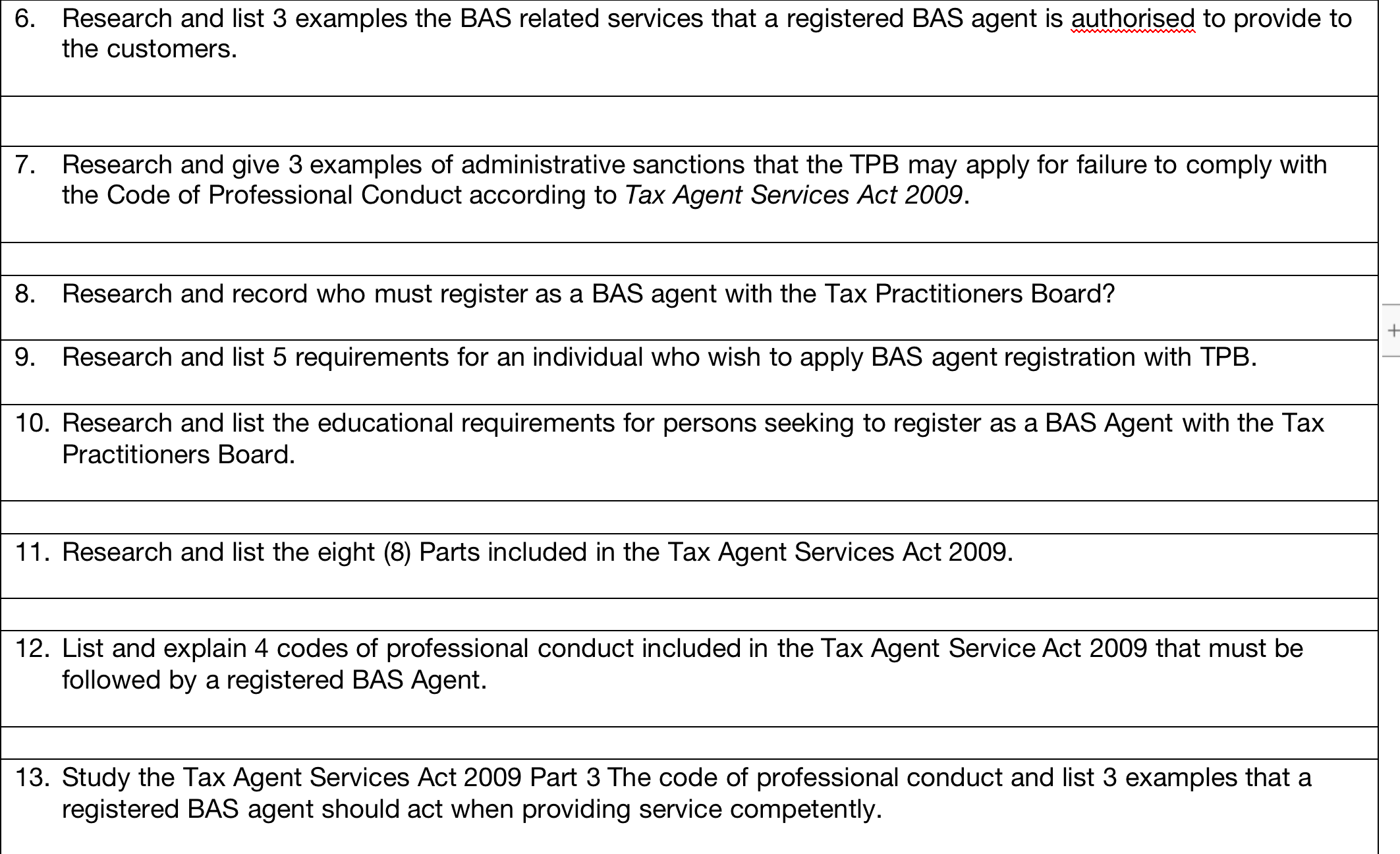

6. Research and list 3 examples the BAS related services that a registered BAS agent is authorised to provide to the customers. 7. Research and give 3 examples of administrative sanctions that the TPB may apply for failure to comply with the Code of Professional Conduct according to Tax Agent Services Act 2009. 8. Research and record who must register as a BAS agent with the Tax Practitioners Board? 9. Research and list 5 requirements for an individual who wish to apply BAS agent registration with TPB. 10. Research and list the educational requirements for persons seeking to register as a BAS Agent with the Tax Practitioners Board. 11. Research and list the eight (8) Parts included in the Tax Agent Services Act 2009. 12. List and explain 4 codes of professional conduct included in the Tax Agent Service Act 2009 that must be followed by a registered BAS Agent. 13. Study the Tax Agent Services Act 2009 Part 3 The code of professional conduct and list 3 examples that a registered BAS agent should act when providing service competently

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts