Question: 6. RISK MANAGEMENT: HEGING (10 MARKS) Part A (5 Marks) An oil refiner purchases crude oil, which it then refines (i.e. processes) into finished products

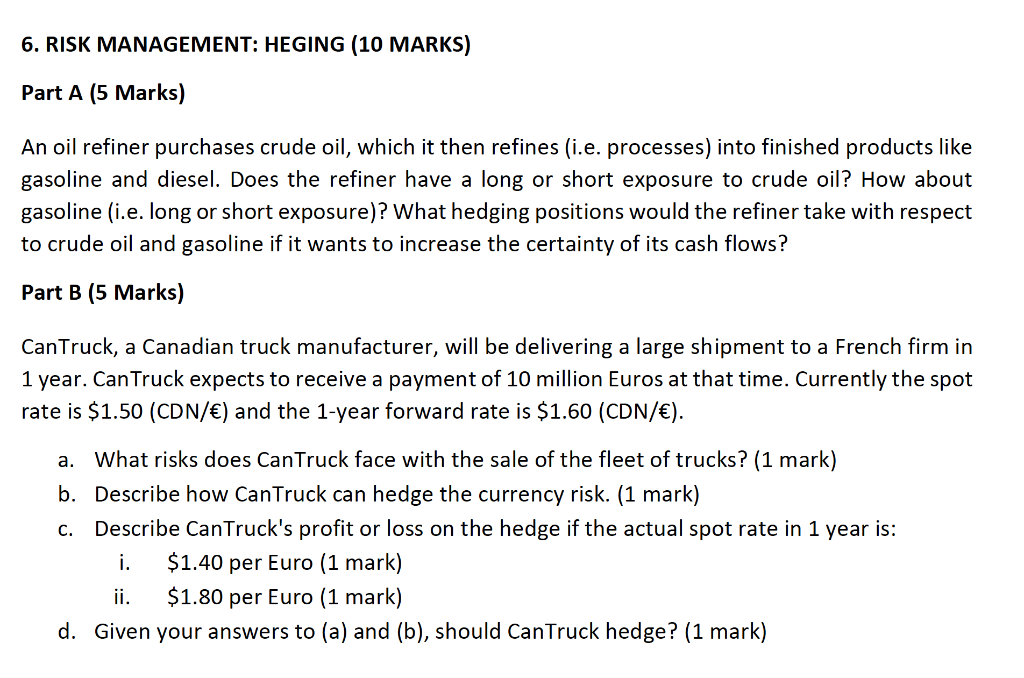

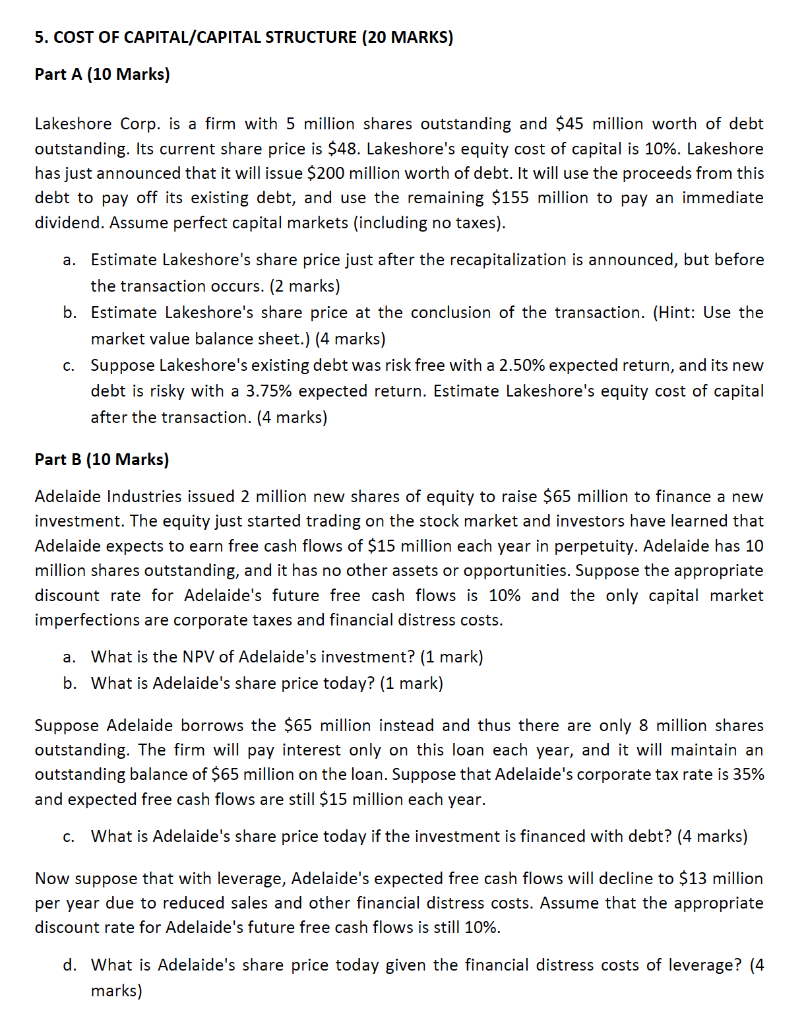

6. RISK MANAGEMENT: HEGING (10 MARKS) Part A (5 Marks) An oil refiner purchases crude oil, which it then refines (i.e. processes) into finished products like gasoline and diesel. Does the refiner have a long or short exposure to crude oil? How about gasoline (i.e. long or short exposure)? What hedging positions would the refiner take with respect to crude oil and gasoline if it wants to increase the certainty of its cash flows? Part B (5 Marks) CanTruck, a Canadian truck manufacturer, will be delivering a large shipment to a French firm in 1 year. Can Truck expects to receive a payment of 10 million Euros at that time. Currently the spot rate is $1.50 (CDN/) and the 1-year forward rate is $1.60 (CDN/). a. What risks does Can Truck face with the sale of the fleet of trucks? (1 mark) b. Describe how Can Truck can hedge the currency risk. (1 mark) C. Describe Can Truck's profit or loss on the hedge if the actual spot rate in 1 year is: i. $1.40 per Euro (1 mark) ii. $1.80 per Euro (1 mark) d. Given your answers to (a) and (b), should Can Truck hedge? (1 mark) 5. COST OF CAPITAL/CAPITAL STRUCTURE (20 MARKS) Part A (10 Marks) Lakeshore Corp. is a firm with 5 million shares outstanding and $45 million worth of debt outstanding. Its current share price is $48. Lakeshore's equity cost of capital is 10%. Lakeshore has just announced that it will issue $200 million worth debt. It will use the proceeds from this debt to pay off its existing debt, and use the remaining $155 million to pay an immediate dividend. Assume perfect capital markets (including no taxes). a. Estimate Lakeshore's share price just after the recapitalization is announced, but before the transaction occurs. (2 marks) b. Estimate Lakeshore's share price at the conclusion of the transaction. (Hint: Use the market value balance sheet.) (4 marks) C. Suppose Lakeshore's existing debt was risk free with a 2.50% expected return, and its new debt is risky with a 3.75% expected return. Estimate Lakeshore's equity cost of capital after the transaction. (4 marks) Part B (10 Marks) Adelaide Industries issued 2 million new shares of equity to raise $65 million to finance a new investment. The equity just started trading on the stock market and investors have learned that Adelaide expects to earn free cash flows of $15 million each year in perpetuity. Adelaide has 10 million shares outstanding, and it has no other assets or opportunities. Suppose the appropriate discount rate for Adelaide's future free cash flows is 10% and the only capital market imperfections are corporate taxes and financial distress costs. a. What is the NPV of Adelaide's investment? (1 mark) b. What is Adelaide's share price today? (1 mark) Suppose Adelaide borrows the $65 million instead and thus there are only 8 million shares outstanding. The firm will pay interest only on this loan each year, and it will maintain an outstanding balance of $65 million on the loan. Suppose that Adelaide's corporate tax rate is 35% and expected free cash flows are still $15 million each year. C. What is Adelaide's share price today if the investment is financed with debt? (4 marks) Now suppose that with leverage, Adelaide's expected free cash flows will decline to $13 million per year due to reduced sales and other financial distress costs. Assume that the appropriate discount rate for Adelaide's future free cash flows is still 10%. d. What is Adelaide's share price today given the financial distress costs of leverage? (4 marks) 6. RISK MANAGEMENT: HEGING (10 MARKS) Part A (5 Marks) An oil refiner purchases crude oil, which it then refines (i.e. processes) into finished products like gasoline and diesel. Does the refiner have a long or short exposure to crude oil? How about gasoline (i.e. long or short exposure)? What hedging positions would the refiner take with respect to crude oil and gasoline if it wants to increase the certainty of its cash flows? Part B (5 Marks) CanTruck, a Canadian truck manufacturer, will be delivering a large shipment to a French firm in 1 year. Can Truck expects to receive a payment of 10 million Euros at that time. Currently the spot rate is $1.50 (CDN/) and the 1-year forward rate is $1.60 (CDN/). a. What risks does Can Truck face with the sale of the fleet of trucks? (1 mark) b. Describe how Can Truck can hedge the currency risk. (1 mark) C. Describe Can Truck's profit or loss on the hedge if the actual spot rate in 1 year is: i. $1.40 per Euro (1 mark) ii. $1.80 per Euro (1 mark) d. Given your answers to (a) and (b), should Can Truck hedge? (1 mark) 5. COST OF CAPITAL/CAPITAL STRUCTURE (20 MARKS) Part A (10 Marks) Lakeshore Corp. is a firm with 5 million shares outstanding and $45 million worth of debt outstanding. Its current share price is $48. Lakeshore's equity cost of capital is 10%. Lakeshore has just announced that it will issue $200 million worth debt. It will use the proceeds from this debt to pay off its existing debt, and use the remaining $155 million to pay an immediate dividend. Assume perfect capital markets (including no taxes). a. Estimate Lakeshore's share price just after the recapitalization is announced, but before the transaction occurs. (2 marks) b. Estimate Lakeshore's share price at the conclusion of the transaction. (Hint: Use the market value balance sheet.) (4 marks) C. Suppose Lakeshore's existing debt was risk free with a 2.50% expected return, and its new debt is risky with a 3.75% expected return. Estimate Lakeshore's equity cost of capital after the transaction. (4 marks) Part B (10 Marks) Adelaide Industries issued 2 million new shares of equity to raise $65 million to finance a new investment. The equity just started trading on the stock market and investors have learned that Adelaide expects to earn free cash flows of $15 million each year in perpetuity. Adelaide has 10 million shares outstanding, and it has no other assets or opportunities. Suppose the appropriate discount rate for Adelaide's future free cash flows is 10% and the only capital market imperfections are corporate taxes and financial distress costs. a. What is the NPV of Adelaide's investment? (1 mark) b. What is Adelaide's share price today? (1 mark) Suppose Adelaide borrows the $65 million instead and thus there are only 8 million shares outstanding. The firm will pay interest only on this loan each year, and it will maintain an outstanding balance of $65 million on the loan. Suppose that Adelaide's corporate tax rate is 35% and expected free cash flows are still $15 million each year. C. What is Adelaide's share price today if the investment is financed with debt? (4 marks) Now suppose that with leverage, Adelaide's expected free cash flows will decline to $13 million per year due to reduced sales and other financial distress costs. Assume that the appropriate discount rate for Adelaide's future free cash flows is still 10%. d. What is Adelaide's share price today given the financial distress costs of leverage? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts