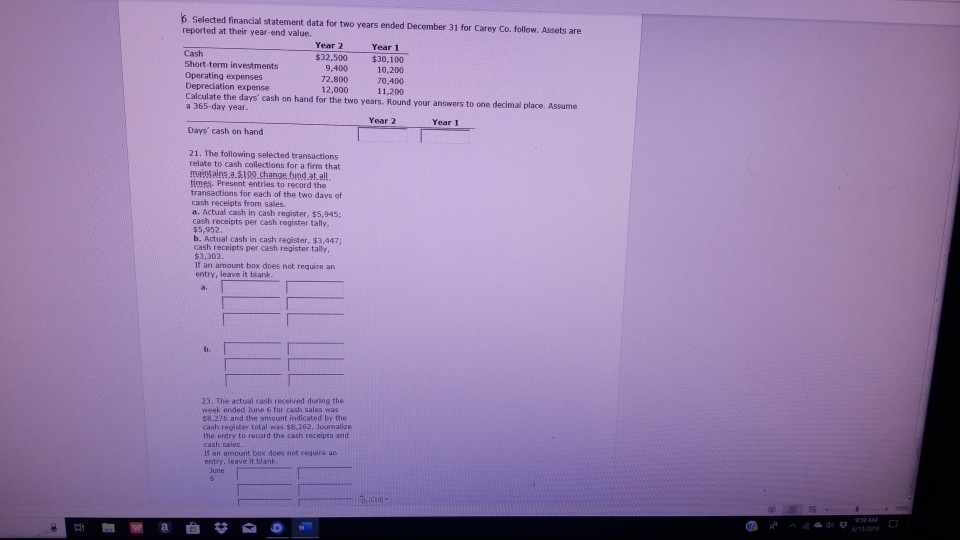

Question: 6. Selected financial statement data for two years ended December 31 for Carey Co. follow. Assets are reported at their year-end value. Year 2 Year

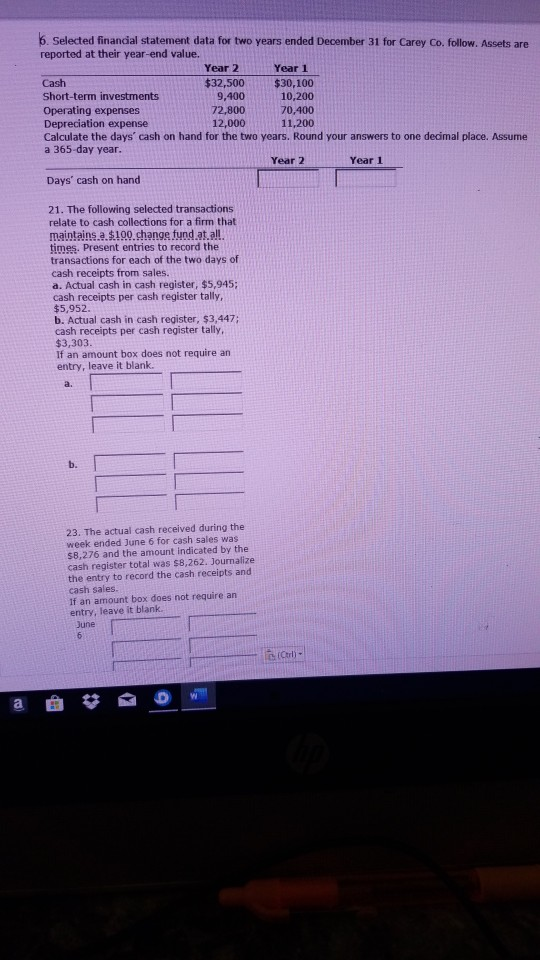

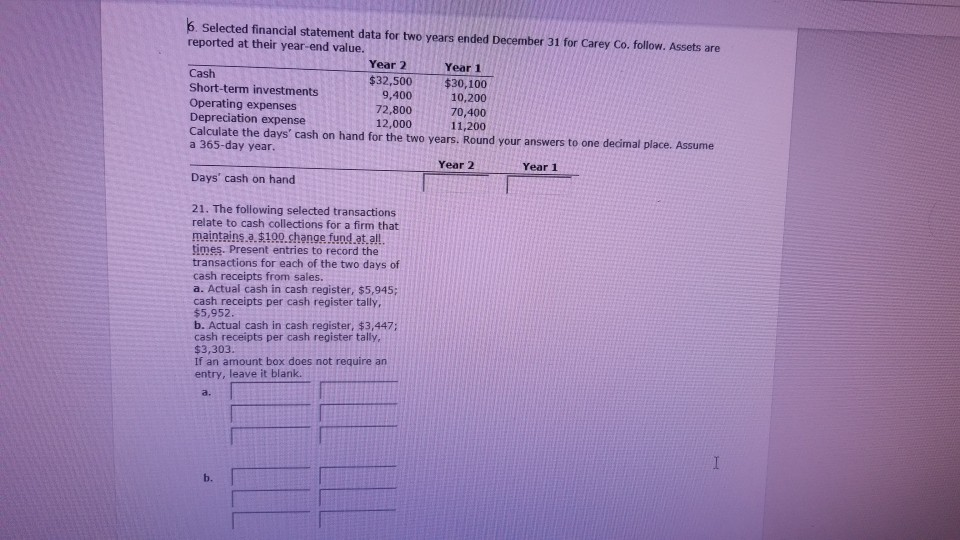

6. Selected financial statement data for two years ended December 31 for Carey Co. follow. Assets are reported at their year-end value. Year 2 Year 1 Cash $32,500 $30,100 10,200 Short-term investments Operating expenses Deprediation expense Calculate the days' cash on hand for the two years. Round your answers to one decimal place. Assume a 365-day year. 9,400 72,800 12,000 70.400 11,200 Year 2 Year 1 Days' cash on hand 21. The following selected transactions relate to cash collections for a firm that: maintains a $199,change fund at all times. Present entries to record the transactions for each of the two days of cash receipts from sales. a. Actual cash in cash register, $5,945; cash receipts per cash register tally, $5,952. b. Actual cash in cash register, $3,447; cash receipts per cash register tally, $3,303. If an amount box does not require an entry, leave it blank 23. The actual cash received during the week ended June 6 for cash sales was $8,276 and the amount indicated by the cash register total was $8,262. Journalize the entry to record the cash receipts and cash sales. If an amount box does not require an entry, leave it blank. June cull 9AM a 6 Selected financial statement data for two years ended December 31 for Carey Co. follow. Assets are reported at their year-end value. Year 2 Year 1 $32,500 Cash $30,100 10,200 9,400 72,800 12,000 Short-term investments Operating expenses Depreciation expense Calculate the days' cash on hand for the two years. Round your answers to one decimal place. Assume a 365-day year. 70,400 11,200 Year 2 Year 1 Days' cash on hand 21. The following selected transactions relate to cash collections for a firm that maintains a.190.change fund at all. times. Present entries to record the transactions for each of the two days of cash receipts from sales. a. Actual cash in cash register, $5,945; cash receipts per cash register tally, $5,952. b. Actual cash in cash register, $3,447; cash receipts per cash register tally, $3,303. If an amount box does not require an entry, leave it blank. a. b. 23. The actual cash received during the week ended June 6 for cash sales was $8,276 and the amount indicated by the cash register total was $8,262. Journalize the entry to record the cash receipts and cash sales. If an amount box does not require an entry, leave it blank. June 6 (Ctrl)- a 6. Selected financial statement data for two years ended December 31 for Carey Co. follow. Assets are reported at their year-end value. Year 2 Year 1 Cash Short-term investments $32,500 $30,100 10,200 9,400 Operating expenses Depreciation expense Calculate the days' cash on hand for the two years. Round your answers to one decimal place. Assume a 365-day year. 72,800 12,000 70,400 11,200 Year 2 Year 1 Days' cash on hand 21. The following selected transactions relate to cash collections for a firm that maintains.a.$100 change fund at.all. times. Present entries to record the transactions for each of the two days of cash receipts from sales. a. Actual cash in cash register, $5,945; cash receipts per cash register tally, $5,952. b. Actual cash in cash register, $3,447; cash receipts per cash register tally, $3,303. If an amount box does not require an entry, leave it blank. a. b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock