Question: 6. Short-term financing Cash flows from operations may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may

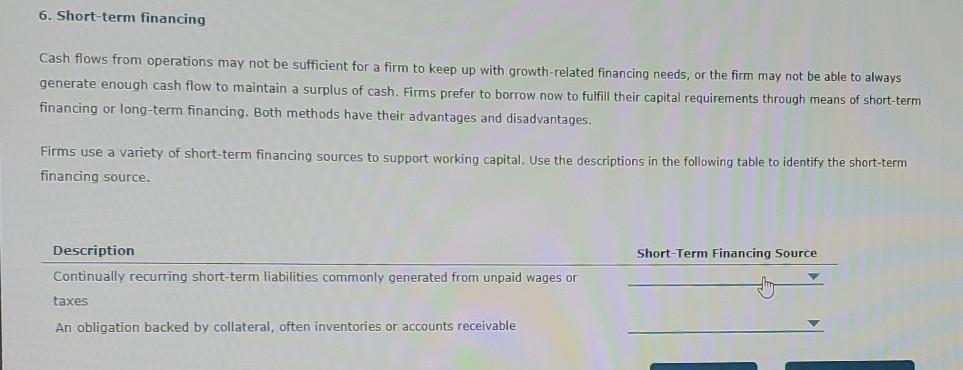

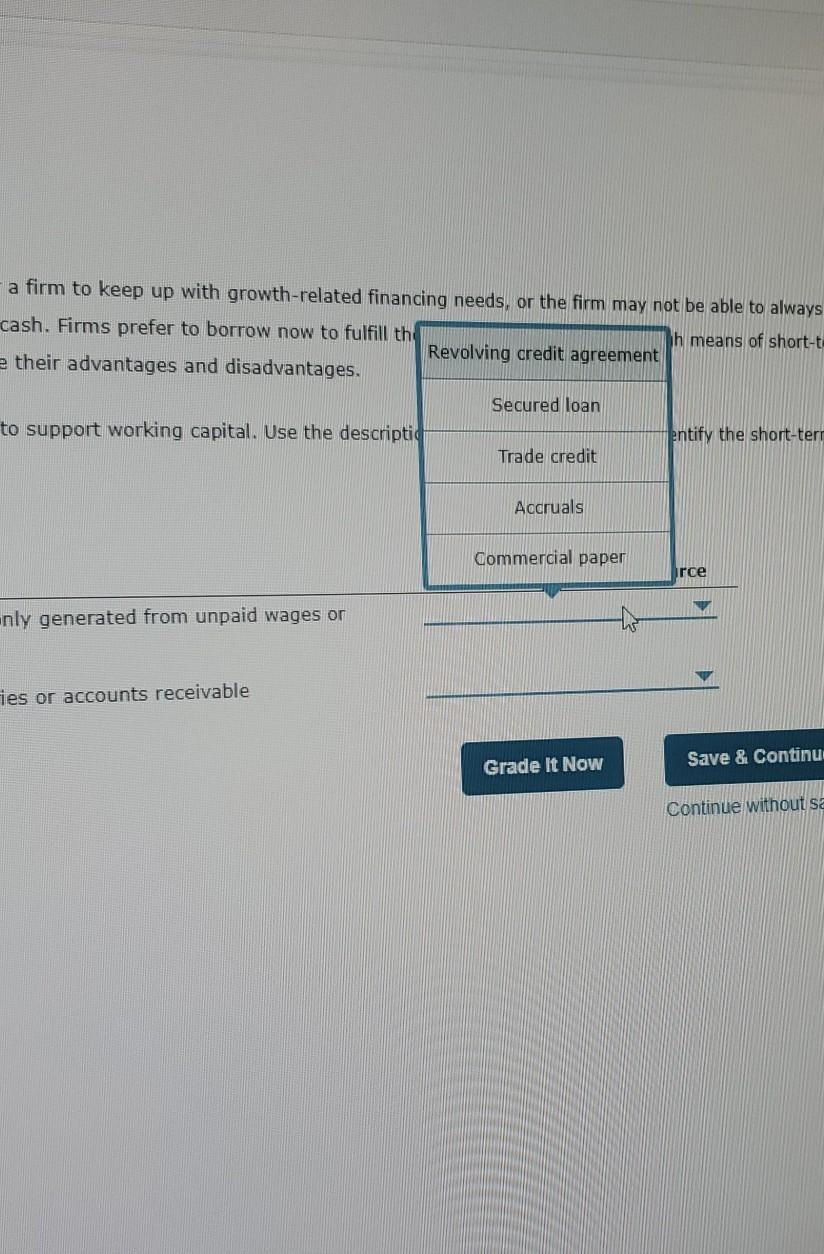

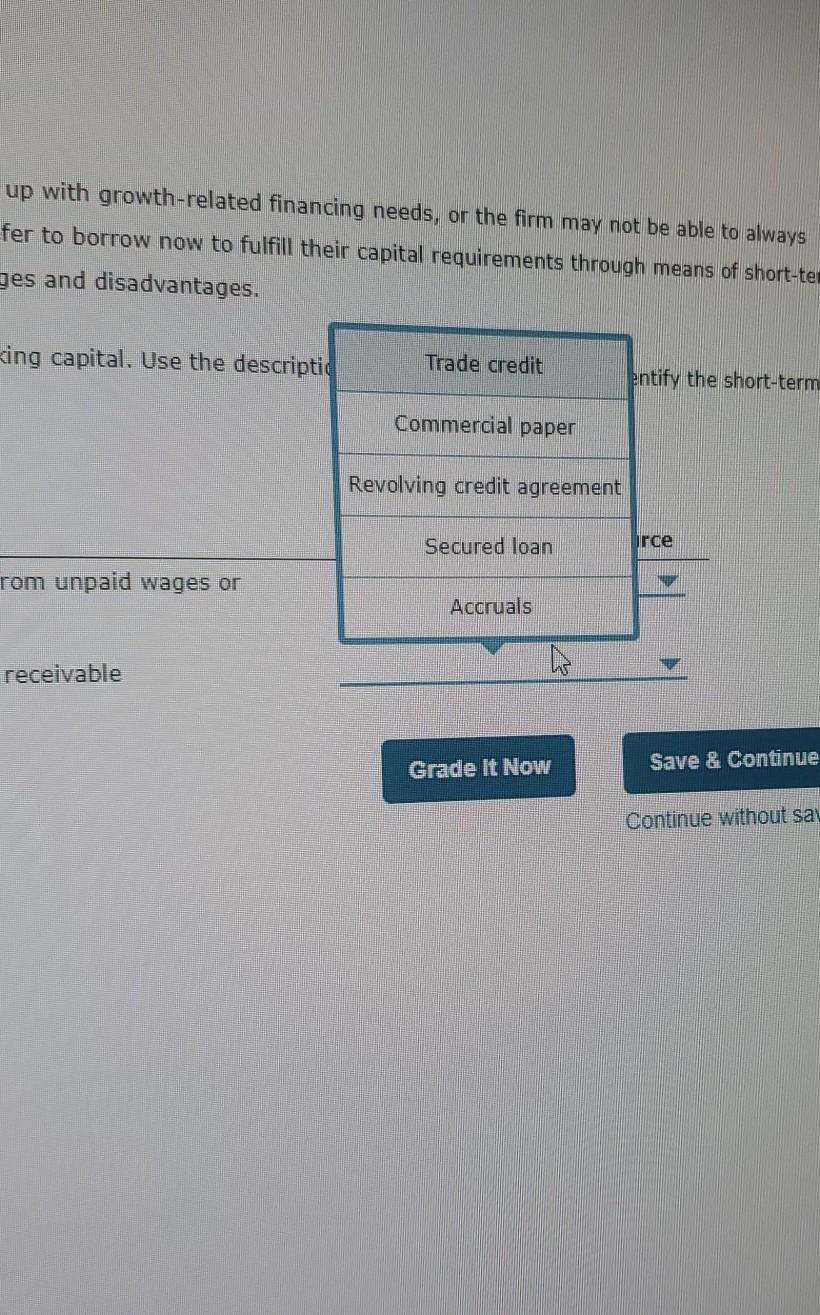

6. Short-term financing Cash flows from operations may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may not be able to always generate enough cash flow to maintain a surplus of cash. Firms prefer to borrow now to fulfill their capital requirements through means of short-term financing or long-term financing. Both methods have their advantages and disadvantages. Firms use a variety of short-term financing sources to support working capital. Use the descriptions in the following table to identify the short-term financing source. Short-Term Financing Source Description Continually recurring short-term liabilities commonly generated from unpaid wages or taxes An obligation backed by collateral, often inventories or accounts receivable a firm to keep up with growth-related financing needs, or the firm may not be able to always cash. Firms prefer to borrow now to fulfill the h means of short-t Revolving credit agreement their advantages and disadvantages. Secured loan to support working capital. Use the descriptio entify the short-teri Trade credit Accruals Commercial paper rce nly generated from unpaid wages or ies or accounts receivable Grade It Now Save & Continui Continue without sa up with growth-related financing needs, or the firm may not be able to always fer to borrow now to fulfill their capital requirements through means of short-tes ges and disadvantages. king capital. Use the descriptio Trade credit entify the short-term Commercial paper Revolving credit agreement Secured loan urce rom unpaid wages or Accruals receivable Grade It Now Save & Continue Continue without say

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts