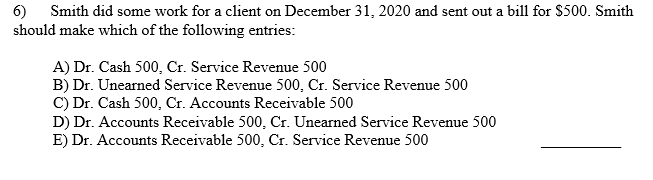

Question: 6) Smith did some work for a client on December 31, 2020 and sent out a bill for $500. Smith should make which of the

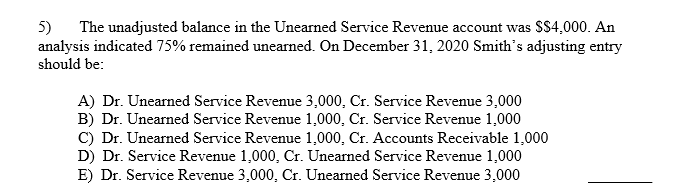

6) Smith did some work for a client on December 31, 2020 and sent out a bill for $500. Smith should make which of the following entries: A) Dr. Cash 500. Cr. Service Revenue 500 B) Dr. Unearned Service Revenue 500. Cr. Service Revenue 500 C) Dr. Cash 500. Cr. Accounts Receivable 500 D) Dr. Accounts Receivable 500. Cr. Unearned Service Revenue 500 E) Dr. Accounts Receivable 500. Cr. Service Revenue 500 5) The unadjusted balance in the Unearned Service Revenue account was $S4,000. An analysis indicated 75% remained unearned. On December 31, 2020 Smith's adjusting entry should be: A) Dr. Unearned Service Revenue 3,000, Cr. Service Revenue 3,000 B) Dr. Unearned Service Revenue 1,000. Cr. Service Revenue 1,000 C) Dr. Unearned Service Revenue 1,000. Cr. Accounts Receivable 1,000 D) Dr. Service Revenue 1,000. Cr. Unearned Service Revenue 1,000 E) Dr. Service Revenue 3,000. Cr. Unearned Service Revenue 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts