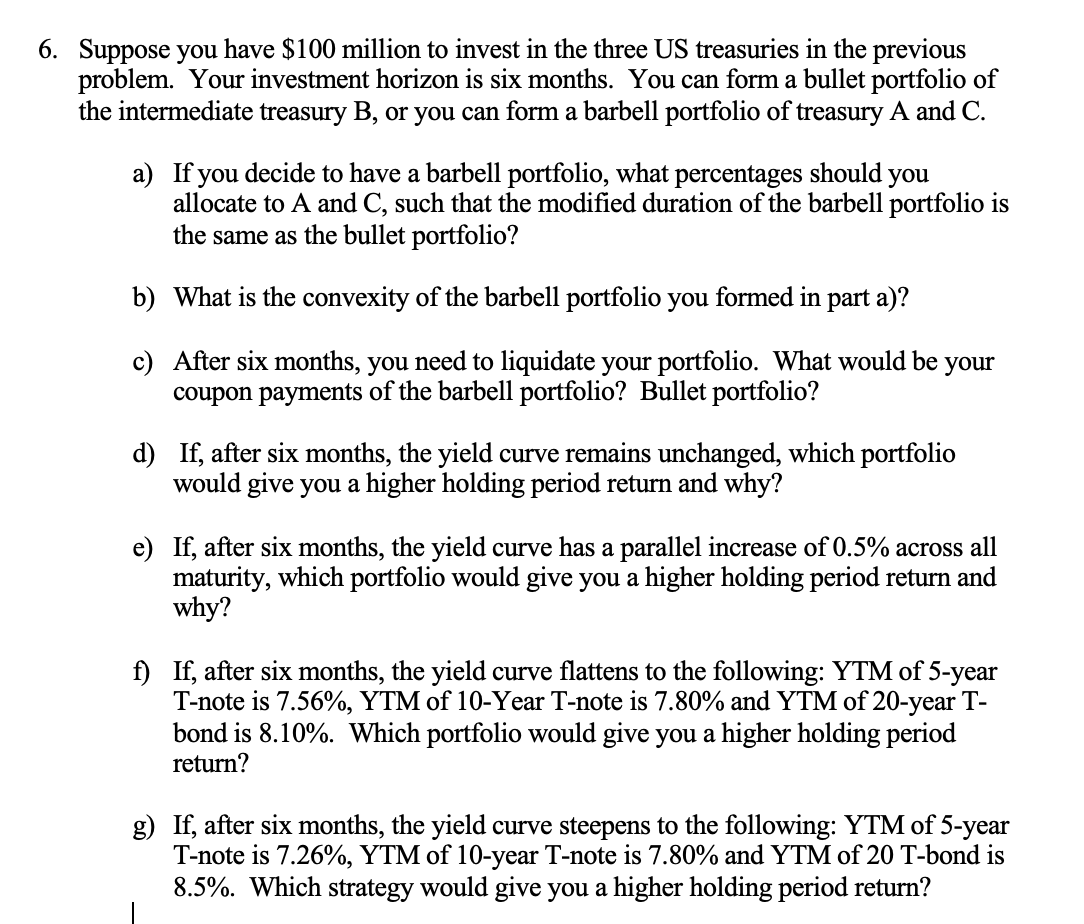

Question: 6 . Suppose you have ( $ 1 0 0 ) million to invest in the three US treasuries in the previous

Suppose you have $ million to invest in the three US treasuries in the previous problem. Your investment horizon is six months. You can form a bullet portfolio of the intermediate treasury B or you can form a barbell portfolio of treasury A and C a If you decide to have a barbell portfolio, what percentages should you allocate to A and C such that the modified duration of the barbell portfolio is the same as the bullet portfolio? b What is the convexity of the barbell portfolio you formed in part a c After six months, you need to liquidate your portfolio. What would be your coupon payments of the barbell portfolio? Bullet portfolio? d If after six months, the yield curve remains unchanged, which portfolio would give you a higher holding period return and why? e If after six months, the yield curve has a parallel increase of across all maturity, which portfolio would give you a higher holding period return and why? f If after six months, the yield curve flattens to the following: YTM of year Tnote is YTM of Year Tnote is and YTM of year Tbond is Which portfolio would give you a higher holding period return? g If after six months, the yield curve steepens to the following: YTM of year Tnote is YTM of year Tnote is and YTM of Tbond is Which strategy would give you a higher holding period return?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock