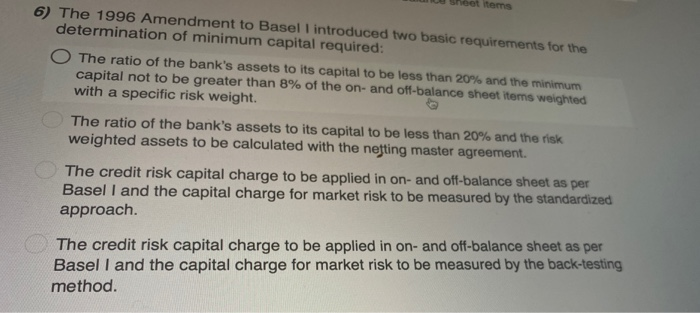

Question: 6) The 1996 Amendment to Basel I introduced two basic requirements for the determination of minimum capital required: The ratio of the bank's assets to

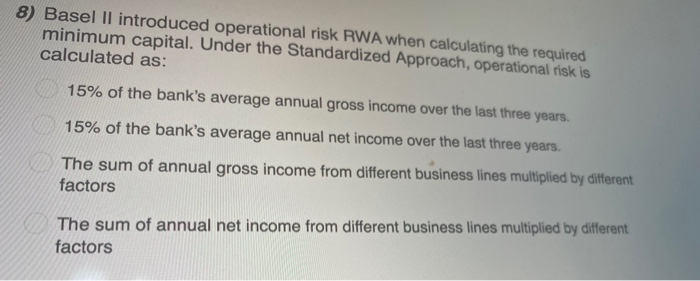

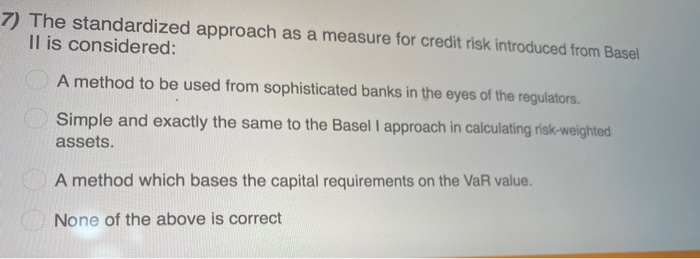

6) The 1996 Amendment to Basel I introduced two basic requirements for the determination of minimum capital required: The ratio of the bank's assets to its capital to be less than 20% and the minimum capital not to be greater than 8% of the on- and off-balance sheet items weighted with a specific risk weight. The ratio of the bank's assets to its capital to be less than 20% and the risk weighted assets to be calculated with the nefting master agreement. The credit risk capital charge to be applied in on- and off-balance sheet as per Basel I and the capital charge for market risk to be measured by the standardized approach. The credit risk capital charge to be applied in on- and off-balance sheet as per Basel I and the capital charge for market risk to be measured by the back-testing method. 8) Basel II introduced operational risk RWA when calculating the required minimum capital. Under the Standardized Approach, operational risk is calculated as: 15% of the bank's average annual gross income over the last three years. 15% of the bank's average annual net income over the last three years. The sum of annual gross income from different business lines multiplied by different factors The sum of annual net income from different business lines multiplied by different factors 7) The standardized approach as a measure for credit risk introduced from Basel Il is considered: A method to be used from sophisticated banks in the eyes of the regulators. Simple and exactly the same to the Basel I approach in calculating risk-weighted assets. A method which bases the capital requirements on the VaR value. None of the above is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts