Question: 6. The balance sheet for ABC Bank is presented below ( $ million): If fixed loans have maturity of 4 years, priced at par, pay

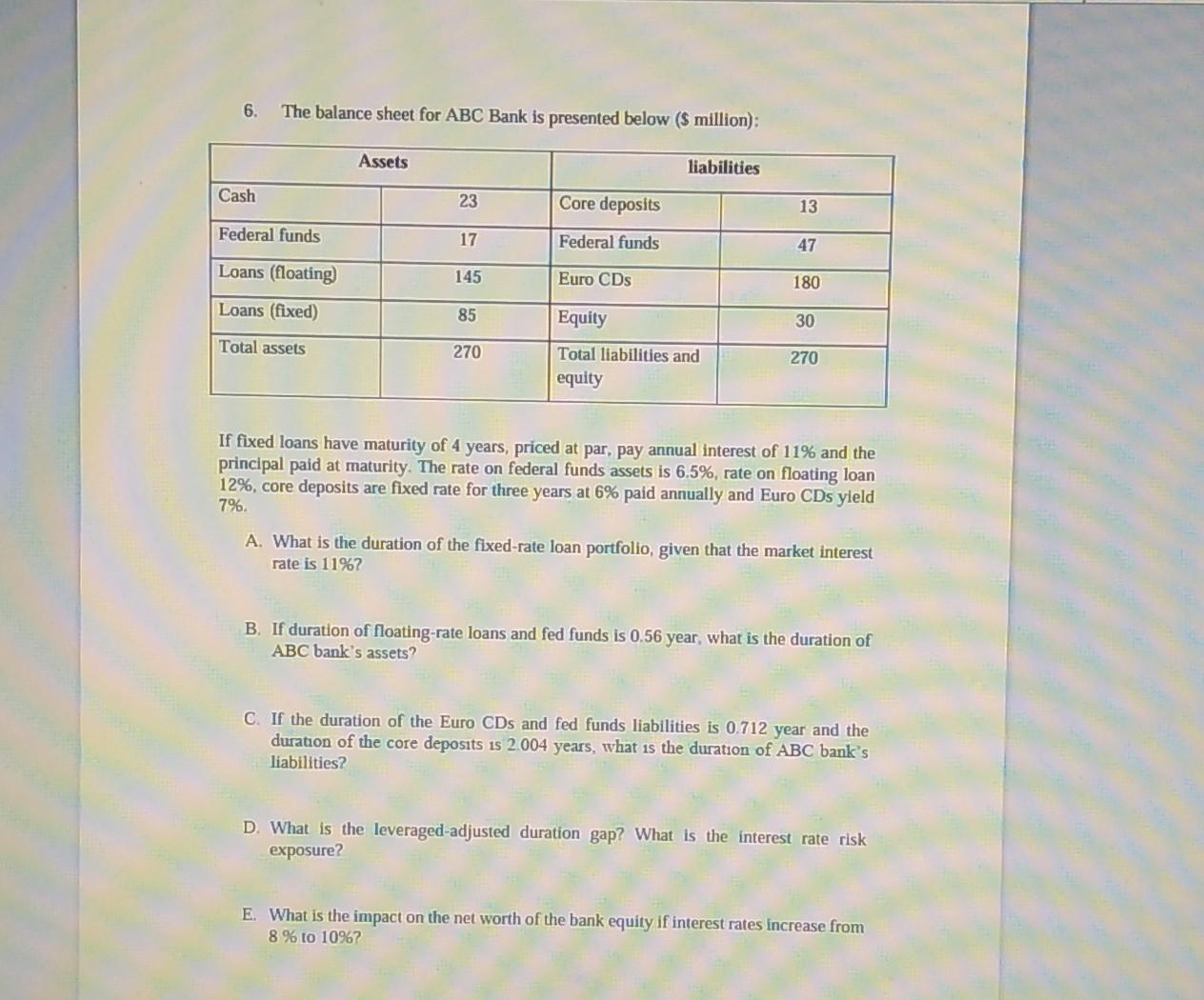

6. The balance sheet for ABC Bank is presented below ( $ million): If fixed loans have maturity of 4 years, priced at par, pay annual interest of 11% and the principal paid at maturity. The rate on federal funds assets is 6.5%, rate on floating loan 12%, core deposits are fixed rate for three years at 6% paid annually and Euro CDs yield 7%. A. What is the duration of the fixed-rate loan portfolio, given that the market interest rate is 11% ? B. If duration of floating-rate loans and fed funds is 0.56 year, what is the duration of ABC bank's assets? C. If the duration of the Euro CDs and fed funds liabilities is 0.712 year and the duration of the core deposits is 2.004 years, what is the duration of ABC bank's liabilities? D. What is the leveraged-adjusted duration gap? What is the interest rate risk exposure? E. What is the impact on the net worth of the bank equity if interest rates increase from 8% to 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts