Question: 6. TW is expected to earn $1.00 per share next year. Book value per share is $10.00 now. Therefore, the return on equity is 10%

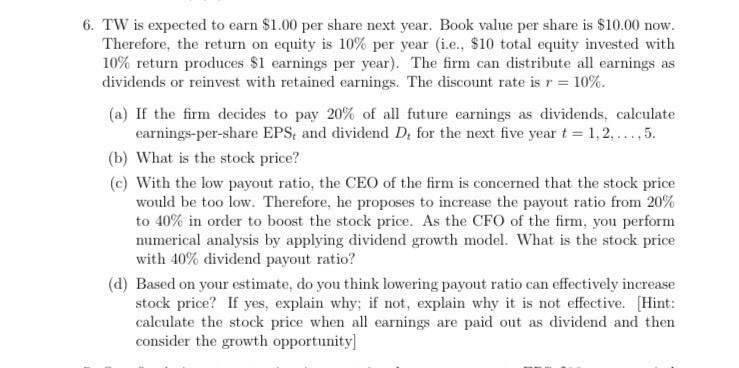

6. TW is expected to earn $1.00 per share next year. Book value per share is $10.00 now. Therefore, the return on equity is 10% per year (i.e., $10 total equity invested with 10% return produces $1 earnings per year). The firm can distribute all earnings as dividends or reinvest with retained earnings. The discount rate is r=10%. (a) If the firm decides to pay 20% of all future earnings as dividends, calculate earnings-per-share EPSt and dividend Dt for the next five year t=1,2,,5. (b) What is the stock price? (c) With the low payout ratio, the CEO of the firm is concerned that the stock price would be too low. Therefore, he proposes to increase the payout ratio from 20% to 40% in order to boost the stock price. As the CFO of the firm, you perform numerical analysis by applying dividend growth model. What is the stock price with 40% dividend payout ratio? (d) Based on your estimate, do you think lowering payout ratio can effectively increase stock price? If yes, explain why; if not, explain why it is not effective. [Hint: calculate the stock price when all earnings are paid out as dividend and then consider the growth opportunity] 6. TW is expected to earn $1.00 per share next year. Book value per share is $10.00 now. Therefore, the return on equity is 10% per year (i.e., $10 total equity invested with 10% return produces $1 earnings per year). The firm can distribute all earnings as dividends or reinvest with retained earnings. The discount rate is r=10%. (a) If the firm decides to pay 20% of all future earnings as dividends, calculate earnings-per-share EPSt and dividend Dt for the next five year t=1,2,,5. (b) What is the stock price? (c) With the low payout ratio, the CEO of the firm is concerned that the stock price would be too low. Therefore, he proposes to increase the payout ratio from 20% to 40% in order to boost the stock price. As the CFO of the firm, you perform numerical analysis by applying dividend growth model. What is the stock price with 40% dividend payout ratio? (d) Based on your estimate, do you think lowering payout ratio can effectively increase stock price? If yes, explain why; if not, explain why it is not effective. [Hint: calculate the stock price when all earnings are paid out as dividend and then consider the growth opportunity]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts