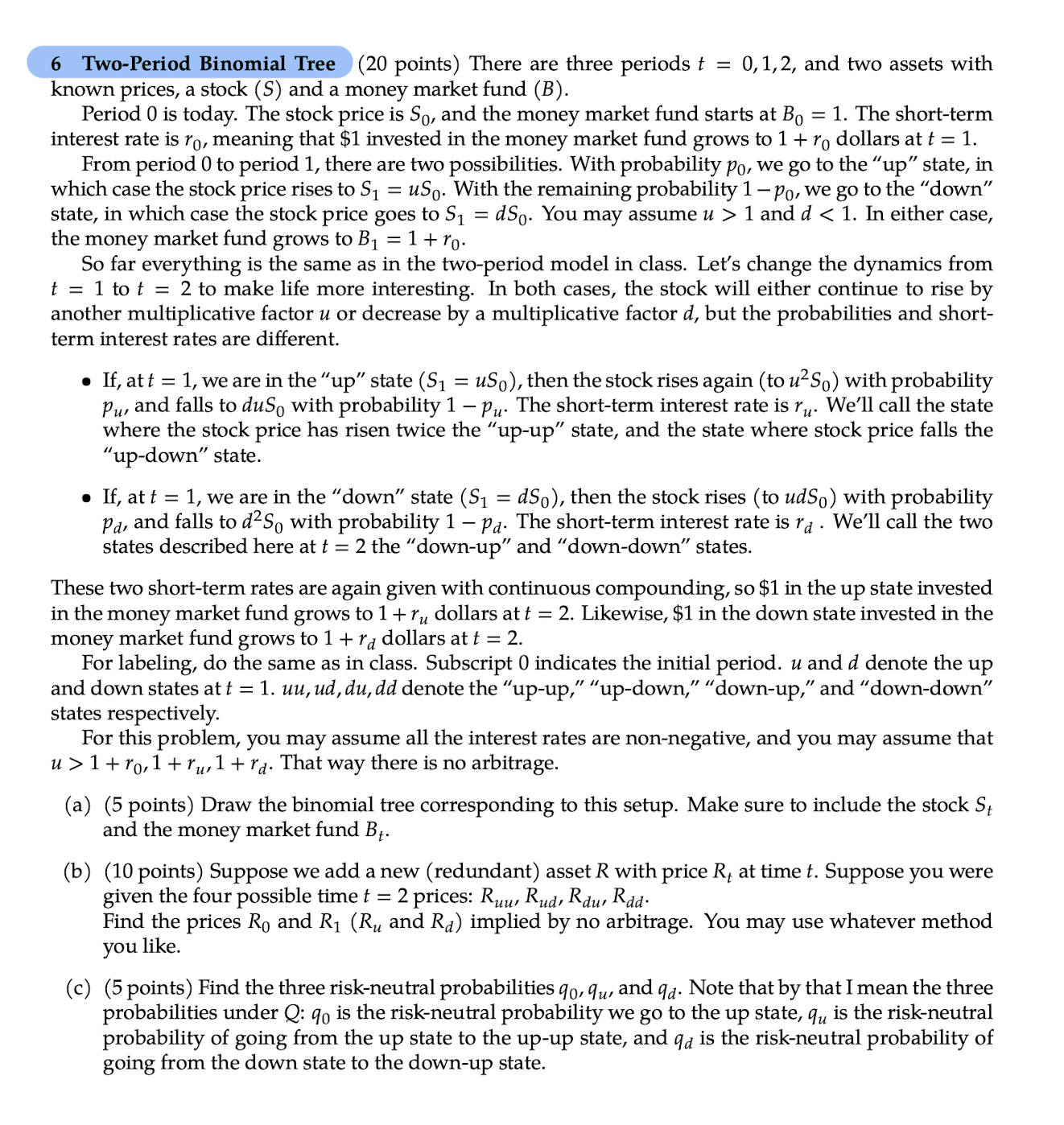

Question: 6 Two - Period Binomial Tree ( 2 0 points ) There are three periods t = 0 , 1 , 2 , and two

TwoPeriod Binomial Tree points There are three periods and two assets with

known prices, a stock and a money market fund

Period today. The stock price and the money market fund starts The shortterm

interest rate meaning that $ invested the money market fund grows dollars

From period period there are two possibilities. With probability the state,

which case the stock price rises With the remaining probability the "down"

state, which case the stock price goes You may assume and either case,

the money market fund grows

far everything the same the twoperiod model class. Let's change the dynamics from

make life more interesting. both cases, the stock will either continue rise

another multiplicative factor decrease a multiplicative factor but the probabilities and short

term interest rates are different.

and falls with probability The shortterm interest rate We'll call the state

where the stock price has risen twice the state, and the state where stock price falls the

down" state.

are the "down" state : with probability

and falls with probability The shortterm interest rate We'll call the two

states described here the "down and "downdown" states.

These two shortterm rates are again given with continuous compounding, $ the state invested

the money market fund grows dollars Likewise, $ the down state invested the

money market fund grows dollars

For labeling, the same class. Subscript indicates the initial period. and denote the

and down states

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock