Question: 6. Under Ricardian Equivalence, a decrease in (lump sum) taxes, not met by a change in current or future government spending, will: (a) Cause the

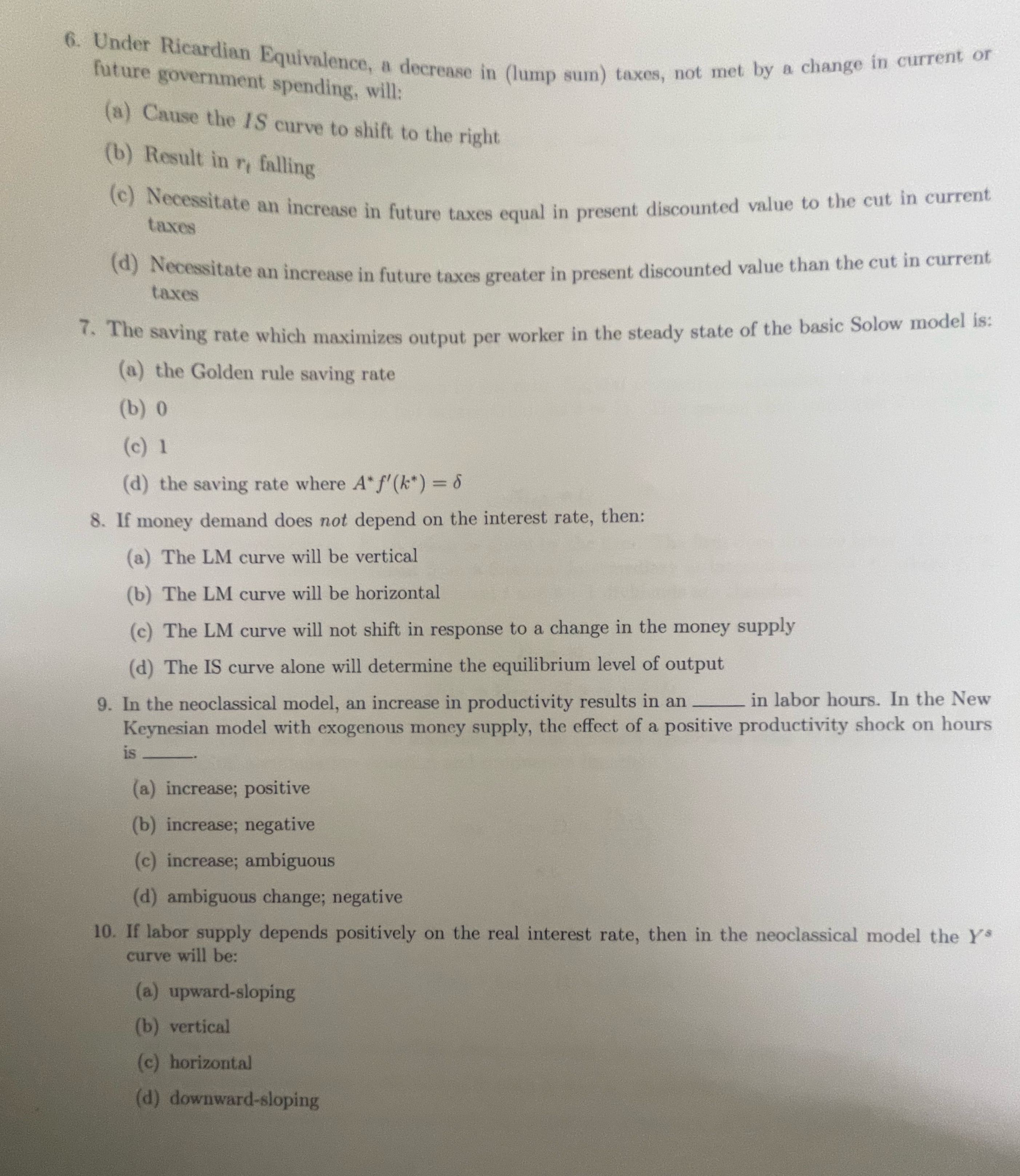

6. Under Ricardian Equivalence, a decrease in (lump sum) taxes, not met by a change in current or future government spending, will: (a) Cause the IS curve to shift to the right (b) Result in r, falling (c) Necessitate an increase in future taxes equal in present discounted value to the cut in current taxes (d) Necessitate an increase in future taxes greater in present discounted value than the cut in current taxes 7. The saving rate which maximizes output per worker in the steady state of the basic Solow model is: (a) the Golden rule saving rate (b) 0 (c) 1 (d) the saving rate where A* f'(k*) = 6 8. If money demand does not depend on the interest rate, then: (a) The LM curve will be vertical (b) The LM curve will be horizontal (c) The LM curve will not shift in response to a change in the money supply (d) The IS curve alone will determine the equilibrium level of output 9. In the neoclassical model, an increase in productivity results in an - in labor hours. In the New Keynesian model with exogenous money supply, the effect of a positive productivity shock on hours is (a) increase; positive (b) increase; negative (c) increase; ambiguous (d) ambiguous change; negative 10. If labor supply depends positively on the real interest rate, then in the neoclassical model the Ys curve will be: (a) upward-sloping (b) vertical (c) horizontal (d) downward-sloping

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts