Question: 6. Under the allowance method, the Allowance for Doubtful Accounts is debited when an account is deemed uncollectible and must be written off. 7. After

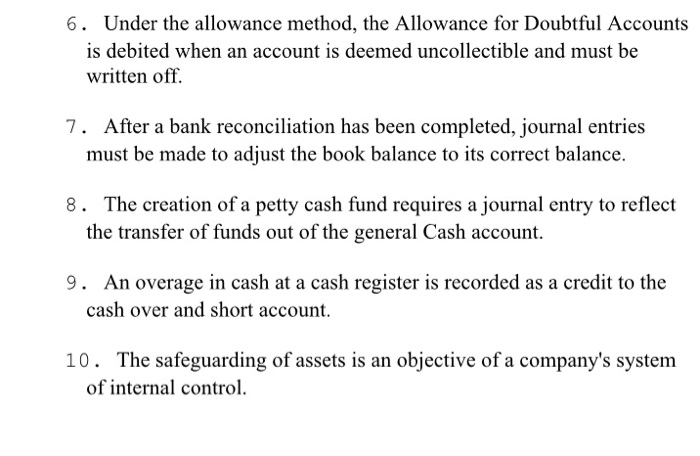

6. Under the allowance method, the Allowance for Doubtful Accounts is debited when an account is deemed uncollectible and must be written off. 7. After a bank reconciliation has been completed, journal entries must be made to adjust the book balance to its correct balance 8. The creation of a petty cash fund requires a journal entry to reflect the transfer of funds out of the general Cash account. 9. An overage in cash at a cash register is recorded as a credit to the cash over and short account 10. The safeguarding of assets is an objective of a company's system of internal control 6. Under the allowance method, the Allowance for Doubtful Accounts is debited when an account is deemed uncollectible and must be written off. 7. After a bank reconciliation has been completed, journal entries must be made to adjust the book balance to its correct balance 8. The creation of a petty cash fund requires a journal entry to reflect the transfer of funds out of the general Cash account. 9. An overage in cash at a cash register is recorded as a credit to the cash over and short account 10. The safeguarding of assets is an objective of a company's system of internal control

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts