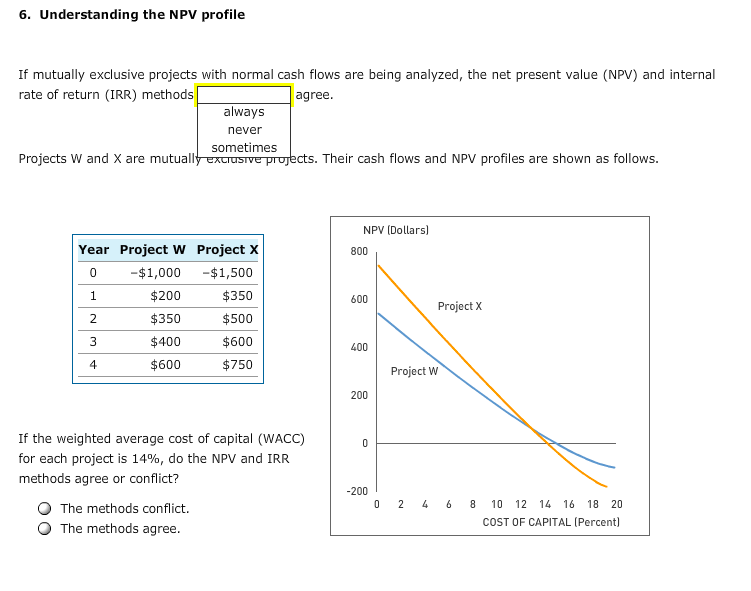

Question: 6. Understanding the NPV profile If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of

6. Understanding the NPV profile If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods agree always never sometimes Projects W and X are mutua cts. Their cash flows and NPV profiles are shown as follows. NPV (Dollars Year Project W Project X 800 $1,000 $1,500 $200 $350 600 Project X $350 $500 $400 $600 400 $750 $600 Project W 200 If the weighted average cost of capital (WACC) for each project is 14%, do the NPV and IRR methods agree or conflict? 200 2 4 6 8 10 12 14 16 18 20 O The methods conflict. COST OF CAPITAL (Percent) O The methods agree

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts