Question: 6. Understanding the NPV profile If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of

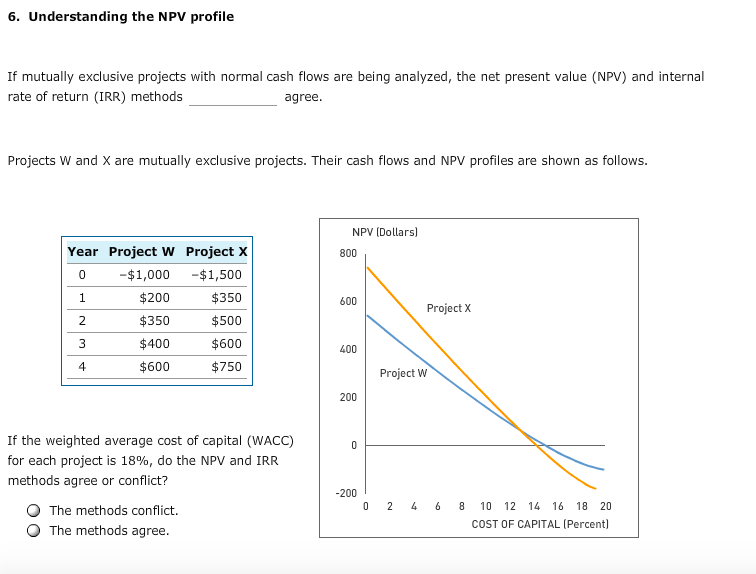

6. Understanding the NPV profile If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods agree Projects W and X are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows. NPV (Dollars) Year Project W Project X 800 $1,000 $1,500 $350 $500 $600 $750 $200 $350 $400 $600 600 Project X 400 4 Project W 200 If the weighted average cost of capital (WACC) for each project is 18%, do the NPV and IRR methods agree or conflict? 200 0 2 4 6 8 10 12 14 16 18 20 The methods conflict. O The methods agree COST OF CAPITAL (Percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts