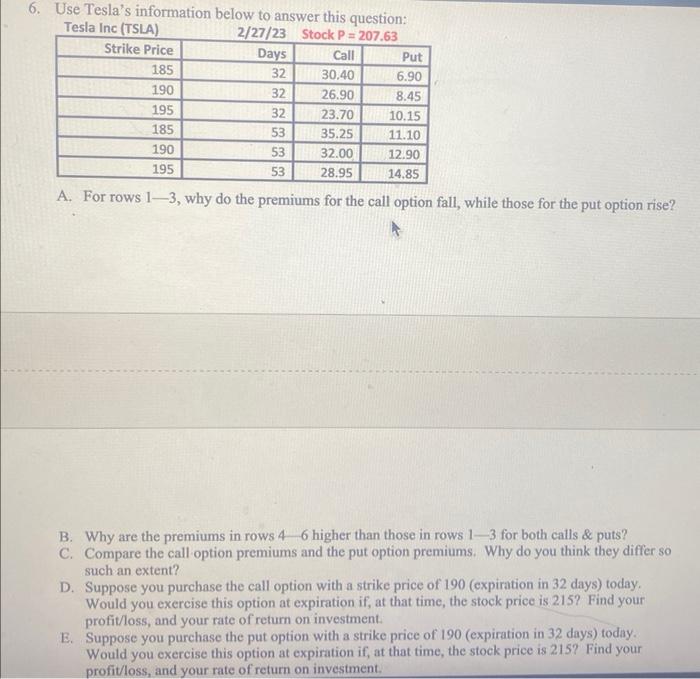

Question: 6. Use Tesla's information below to answer this question: Tacla Imie Itrel A A. For rows 1 -3, why do the premiums for the call

6. Use Tesla's information below to answer this question: Tacla Imie Itrel A A. For rows 1 -3, why do the premiums for the call option fall, while those for the put option rise? B. Why are the premiums in rows 4 higher than those in rows 13 for both calls \& puts? C. Compare the call option premiums and the put option premiums. Why do you think they differ so such an extent? D. Suppose you purchase the call option with a strike price of 190 (expiration in 32 days) today. Would you exercise this option at expiration if, at that time, the stock price is 215? Find your profit/loss, and your rate of return on investment. E. Suppose you purchase the put option with a strike price of 190 (expiration in 32 days) today. Would you exercise this option at expiration if, at that time, the stock price is 215 ? Find your profit/loss, and your rate of return on investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts