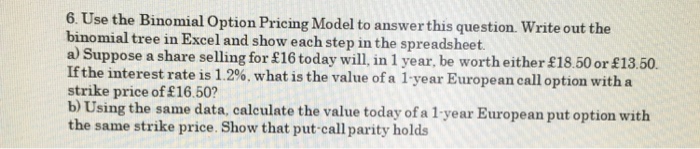

Question: 6. Use the Binomial Option Pricing Model to answer this question. Write out the binomial tree in Excel and show each step in the spreadsheet

6. Use the Binomial Option Pricing Model to answer this question. Write out the binomial tree in Excel and show each step in the spreadsheet a Suppose a share selling for 16 today will, in 1 year, be worth either 18.50 or 13.50 If the interest rate is 1.2%, what is the value of a 1-year European call option with a strike price of 16.50? b) Using the same data, calculate the value today of a 1 year European put option with the same strike price. Show that put call parity holds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts