Question: 6. Using derivatives to reduce risks Aa Aa E Based on your understanding of the operational procedures used by the futures markets in general, indicate

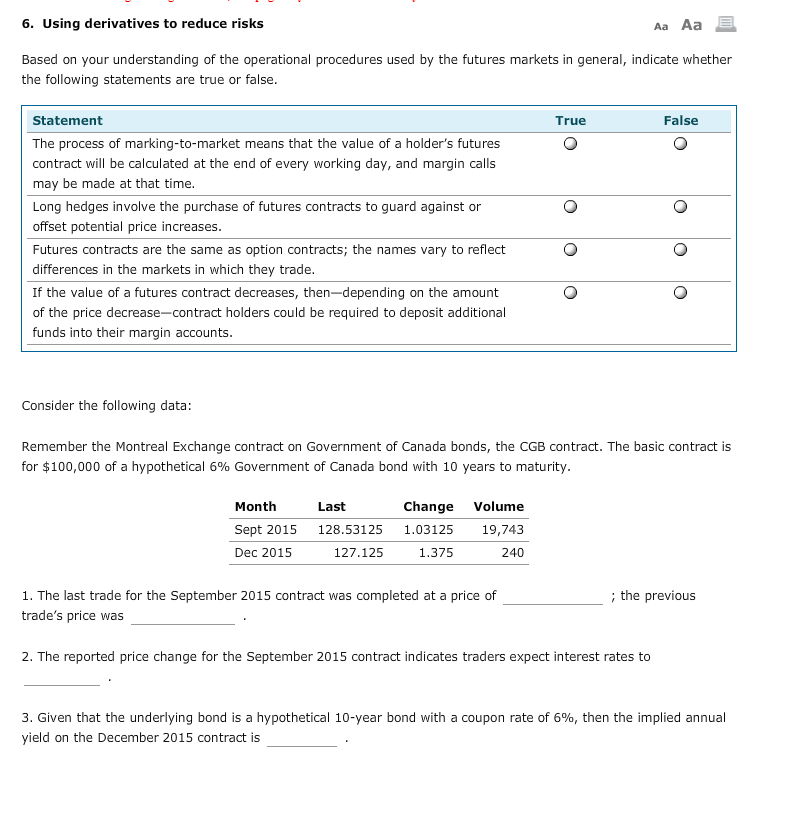

6. Using derivatives to reduce risks Aa Aa E Based on your understanding of the operational procedures used by the futures markets in general, indicate whether the following statements are true or false. True Statement The process of marking-to-market means that the value of a holder's futures contract will be calculated at the end of every working day, and margin calls may be made at that time. Long hedges involve the purchase of futures contracts to guard against or offset potential price increases. Futures contracts are the same as option contracts; the names vary to reflect differences in the markets in which they trade. If the value of a futures contract decreases, then-depending on the amount of the price decrease-contract holders could be required to deposit additional funds into their margin accounts. Consider the following data: Remember the Montreal Exchange contract on Government of Canada bonds, the CGB contract. The basic contract is for $100,000 of a hypothetical 6% Government of Canada bond with 10 years to maturity. Month Sept 2015 Dec 2015 Last 128.53125 127.125 Change 1.03125 1.375 Volume 19,743 240 1. The last trade for the September 2015 contract was completed at a price of trade's price was ; the previous 2. The reported price change for the September 2015 contract indicates traders expect interest rates to 3. Given that the underlying bond is a hypothetical 10-year bond with a coupon rate of 6%, then the implied annual yield on the December 2015 contract is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts