Question: 6. Using the expected cash flows given above, what is the estimated value of the property, Vo, if purchased using all cash and if estimated

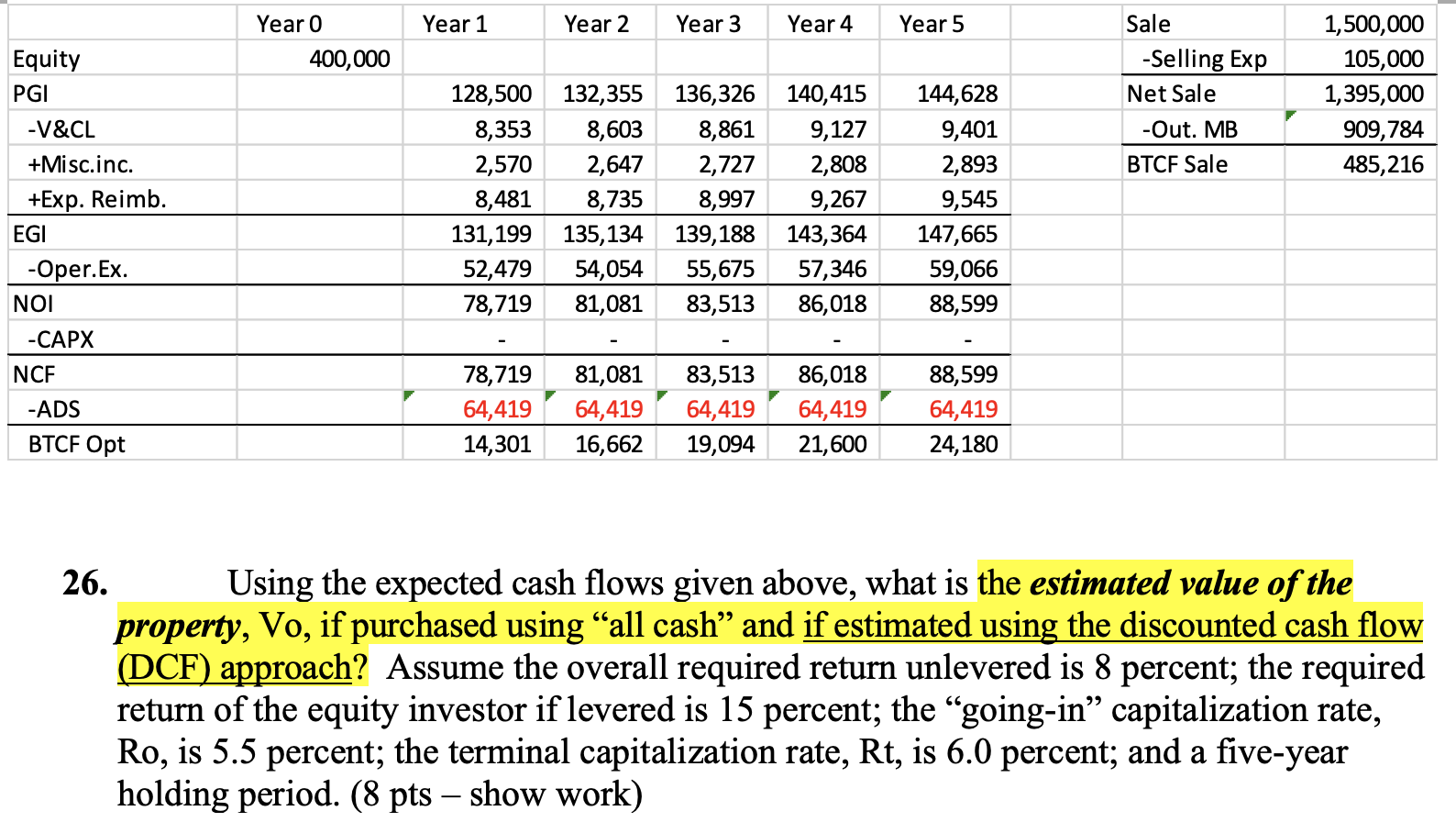

6. Using the expected cash flows given above, what is the estimated value of the property, Vo, if purchased using "all cash" and if estimated using the discounted cash flow (DCF) approach? Assume the overall required return unlevered is 8 percent; the required return of the equity investor if levered is 15 percent; the "going-in" capitalization rate, Ro, is 5.5 percent; the terminal capitalization rate, Rt, is 6.0 percent; and a five-year holding period. (8 pts - show work) 6. Using the expected cash flows given above, what is the estimated value of the property, Vo, if purchased using "all cash" and if estimated using the discounted cash flow (DCF) approach? Assume the overall required return unlevered is 8 percent; the required return of the equity investor if levered is 15 percent; the "going-in" capitalization rate, Ro, is 5.5 percent; the terminal capitalization rate, Rt, is 6.0 percent; and a five-year holding period. (8 pts - show work)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts