Question: 6. Using the same information in question # 5, what will be the entry to record the amount of depreciation expense for 2014? a. debit

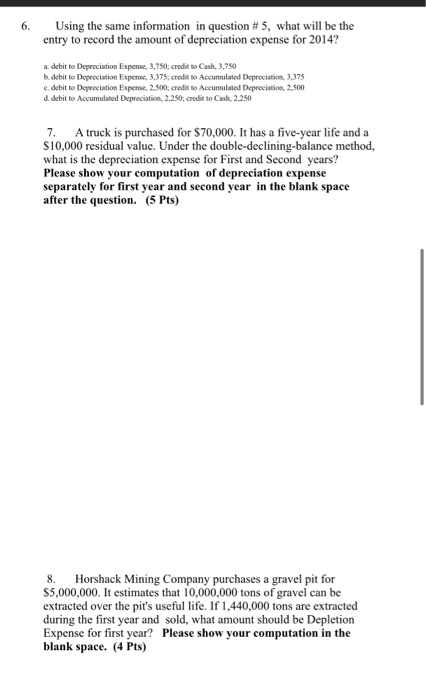

6. Using the same information in question # 5, what will be the entry to record the amount of depreciation expense for 2014? a. debit te Depreciation Expense, 3,750: credit to Cash, 3,750 b. debit to Depreciation Expense 3,375, credit to Accumulated Depreciation 3.375 c. debit to Depreciation Expense, 2,500 credit to Accumulated Depreciation 2.500 d. debit to Accumulated Depreciation 2.250;credit to Cash 2.250 7. A truck is purchased for $70,000. It has a five-year life and a $10,000 residual value. Under the double-declining-balance method, what is the depreciation expense for First and Second years? Please show your computation of depreciation expense separately for first year and second year in the blank space after the question. (5 Pts) 8. Horshack Mining Company purchases a gravel pit for $5,000,000. It estimates that 10,000,000 tons of gravel can be extracted over the pit's useful life. If 1,440,000 tons are extracted during the first year and sold, what amount should be Depletion Expense for first year? Please show your computation in the blank space. (4 Pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts